Introduction

Japan’s renewable energy policy relies on two core revenue support mechanisms: the Feed-in Tariff (FIT) and the Feed-in Premium (FIP) schemes. Together, they define how renewable power projects generate revenue and how market risk is allocated between the government and project developers.

Rather than serving as simple subsidy programs, FIT and FIP function as policy tools that shape developer behavior, financing assumptions, and the degree of market exposure faced by renewable energy projects. This distinction is particularly important for capital-intensive technologies such as offshore wind.

This article explains how the FIT and FIP schemes are structured, what roles they are designed to play within Japan’s renewable energy framework, and where their limitations become apparent when projects move from planning to execution.

While this article focuses on a specific topic, those looking to understand Japan’s overall offshore wind policy and regulatory framework should also read our comprehensive summary here:

👉 Japan’s Offshore Wind Policy & Regulatory Framework Explained

1. FIT Scheme

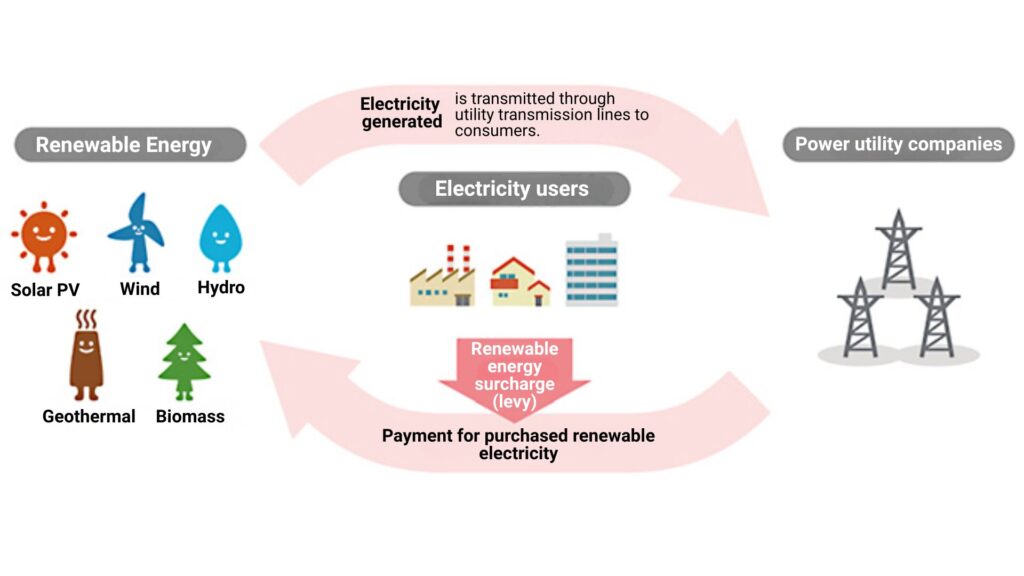

The FIT scheme guarantees that electricity generated from eligible renewable energy sources is purchased at a fixed price for a predefined period. By eliminating exposure to wholesale market price fluctuations, FIT is designed to provide revenue certainty during the early stages of renewable energy deployment.

This revenue stability has played a central role in enabling initial market entry, particularly for technologies and project types that face high upfront capital requirements and long payback periods.

Source: METI Agency for Natural Resources and Energy website

1-1. Applicable Renewable Energy Sources

The FIT scheme applies to five categories of renewable energy: solar, wind, hydro, geothermal, and biomass. Eligible projects must meet national certification requirements and represent new power generation capacity.

In principle, all electricity generated by certified facilities is subject to purchase under FIT. However, for small- and mid-scale solar systems designed primarily for self-consumption, only surplus electricity exported to the grid is eligible. This reflects a policy distinction between utility-scale power generation and distributed energy use.

1-2. Renewable Energy Surcharge

The cost of purchasing renewable electricity under the FIT scheme is funded through a renewable energy surcharge collected from electricity consumers. The surcharge is added to monthly electricity bills and varies in proportion to electricity consumption.

By design, this mechanism socializes the cost of renewable energy deployment across electricity users nationwide. While it supports investment certainty for developers, it also introduces broader policy considerations regarding cost burden, transparency, and long-term sustainability of support levels.

2. FIP Scheme: Market-Linked Incentives

The FIP scheme represents a shift from fixed-price support toward market-linked revenue mechanisms. Under FIP, power producers sell electricity directly into the wholesale market and receive a premium on top of the market price.

This structure is intended to integrate renewable energy into electricity markets, encourage price-aware dispatch, and gradually increase producer responsibility for market participation.

2-1. Key Differences Between FIT and FIP

| Feature | FIT | FIP |

|---|---|---|

| Purchase Price | Fixed rate guaranteed by the government | Market price + premium |

| Imbalance Responsibility | Exempted | Power producers bear responsibility |

| Non-Fossil Value Trading | Not tradable (included in FIT price) | Tradable in the non-fossil certificate market |

2-2. Benefits of the FIP Scheme

Under the FIP scheme, power producers gain flexibility to respond to market signals and optimize sales strategies. In addition, projects that have completed their FIT procurement period may transition to FIP, allowing continued participation in support mechanisms while operating under market-based conditions.

At the same time, this flexibility comes with increased exposure to price volatility and operational responsibilities, marking a clear shift in risk allocation compared to FIT.

3. Challenges and Policy Responses

As renewable energy deployment has expanded, compliance and governance issues have become more visible. In some cases, projects certified under FIT or FIP were found to violate related laws, such as the Farmland Act or Forest Act, leading to temporary suspension of support.

These enforcement actions reflect a broader policy shift toward emphasizing legal compliance, environmental safeguards, and alignment with local communities, rather than focusing solely on capacity expansion.

4. Introduction of Generator-side Levy

To support long-term grid maintenance and expansion, Japan has introduced a generator-side levy, requiring power producers to share part of the system costs. This policy reflects growing attention to equitable cost allocation as renewable penetration increases.

Existing FIT- and FIP-certified projects will become subject to this levy after their procurement periods end, reinforcing the principle that renewable generators also contribute to system sustainability over time.

Conclusion

The FIT and FIP schemes form the backbone of Japan’s renewable energy revenue framework. FIT prioritizes revenue stability and early-stage deployment, while FIP promotes market integration and gradual exposure to price signals.

However, neither scheme is designed to guarantee project success on its own. They define revenue conditions and risk allocation, but execution outcomes remain dependent on market conditions, regulatory compliance, and project-specific assumptions.

Understanding FIT and FIP as policy frameworks—rather than simple financial incentives—is essential for assessing how renewable energy projects function within Japan’s evolving energy system.

For a broader understanding of Japan’s offshore wind legal system, policy structure, and support measures, be sure to check out our pillar article:

🌊 Japan’s Offshore Wind Policy & Regulatory Framework Explained

Explore more categories at DeepWind:

- 🔍Market Insights – Understand the latest trends and key topics in Japan’s offshore wind market

- 🏛️Policy & Regulations – Explore Japan’s legal frameworks, auction systems, and designated promotion zones.

- 🌊Projects – Get an overview of offshore wind projects across Japan’s coastal regions.

- 🛠️Technology & Innovation – Discover the latest technologies and innovations shaping Japan’s offshore wind sector.

- 💡Cost Analysis – Dive into Japan-specific LCOE insights and offshore wind cost structures.