Introduction

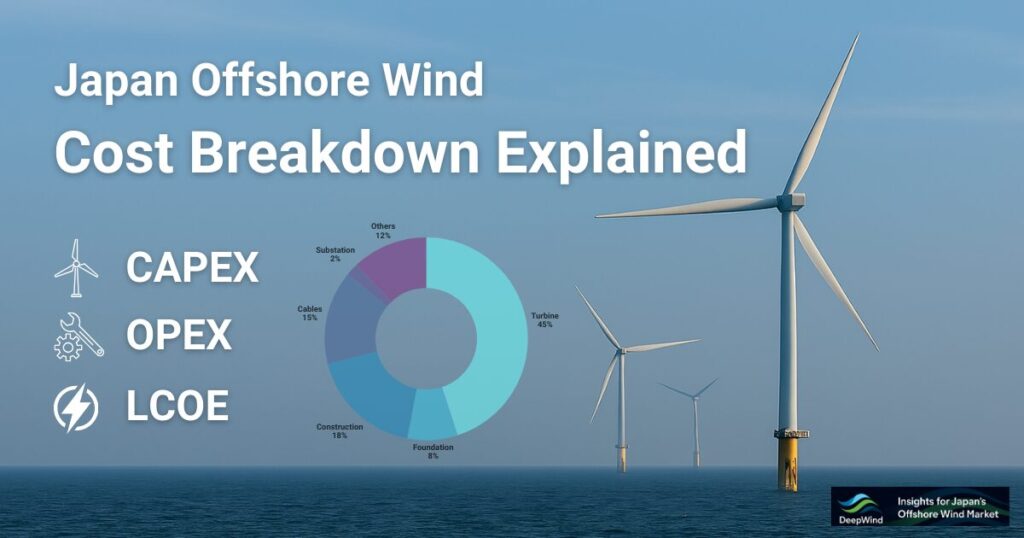

This pillar article provides a comprehensive comparison of Japan’s 12 offshore wind promotion zones designated under the Renewable Energy Sea Area Act. Using key cost and performance indicators—CAPEX, OPEX, LCOE, and IRR—we evaluate and rank each zone on a star scale for investment attractiveness. An interactive national map helps visualize all zones, and direct links lead to detailed analysis for each area.

1. Promotion Zone Map

You can click on the markers in the map to view outline of the projects.

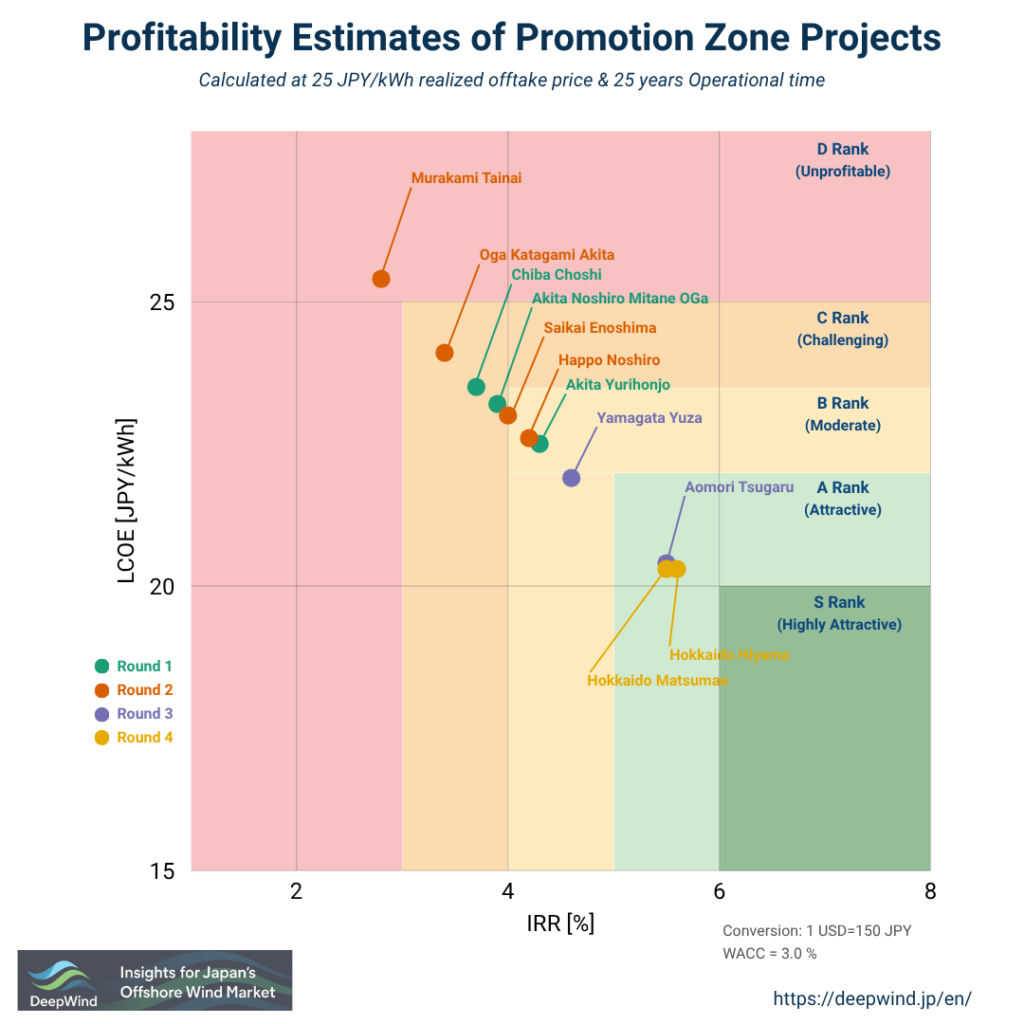

2. Profitability Evaluation Criteria for Promotion Zones

| Rating | IRR | LCOE | Comments |

|---|---|---|---|

| ★★★★★ Highly Attractive | ≥ 6 % | ≤ 20 JPY/kWh | Excellent in both profitability and cost efficiency. Commercially viable even under current conditions. |

| ★★★★ Attractive | 5 – 6 % | 20 – 22 JPY/kWh | High investment potential; profitability achievable depending on site conditions (port and grid distance, etc.). |

| ★★★ Moderate | 4 – 5 % | 22 – 23.5 JPY/kWh | Near the breakeven line; cost reduction and policy support required. |

| ★★ Challenging | 3 – 4 % | 23.5 – 25 JPY/kWh | Low investment appeal; subsidies or regulatory support assumed. |

| ★ Unviable | < 3 % | > 25 JPY/kWh | Unprofitable under current conditions; major cost reductions or technological innovation needed. |

3. Profitability Evaluation Summary of Promotion Zones (12 Zones)

| Area | Capacity | Profitability Score (★1–5) | Profitability Evaluation | Details |

|---|---|---|---|---|

| Goto, Nagasaki | 16.8MW | ★-★★ | Challenging | Read more |

| Noshiro/Mitane/Oga, Akita | 494MW | ★★ | Challenging | Read more |

| Yurihonjo, Akita | 845MW | ★★★ | Moderate | Read more |

| Choshi, Chiba | 403MW | ★★ | Challenging | Read more |

| Happo/Noshiro, Akita | 375MW | ★★★ | Moderate | Read more |

| Oga/Katagami/Akita, Akita | 315MW | ★★ | Challenging | Read more |

| Murakami/Tainai, Niigata | 684MW | ★ | Unviable | Read more |

| Saikai/Enoshima, Nagasaki | 420MW | ★★★ | Moderate | Read more |

| Tsugaru, Aomori | 615MW | ★★★★ | Attractive | Read more |

| Yusa, Yamagata | 450MW | ★★★ | Moderate | Read more |

| Hokkaido Matsumae | 315–320MW | ★★★★ | Attractive | Read more |

| Hokkaido Hiyama | 910–1,140MW | ★★★★ | Attractive | Read more |

Conclusion

In this article, we compared the profitability of Japan’s 12 designated offshore wind promotion zones using CAPEX, OPEX, LCOE, and IRR. The analysis highlights significant differences among zones, with Hokkaido sites showing strong potential.

These figures are based on representative assumptions, and actual project viability will ultimately depend on detailed site conditions and auction frameworks.

For deeper insights, please refer to the individual zone-specific articles. DeepWind will continue to provide in-depth analysis to support investors and developers in navigating Japan’s offshore wind market.

Japan’s offshore wind is no longer constrained by ambition — but by viability.📘 DeepWind Premium Report

A decision-oriented report synthesizing commercial viability, cost/revenue misalignment, supply-chain constraints, and Round 4 implications.

View the report (Gumroad)

- 🔍Market Insights – Understand the latest trends and key topics in Japan’s offshore wind market

- 🏛️Policy & Regulations – Explore Japan’s legal frameworks, auction systems, and designated promotion zones.

- 🌊Projects – Get an overview of offshore wind projects across Japan’s coastal regions.

- 🛠️Technology & Innovation – Discover the latest technologies and innovations shaping Japan’s offshore wind sector.

- 💡Cost Analysis – Dive into Japan-specific LCOE insights and offshore wind cost structures.