As Japan pushes forward with its offshore wind ambitions, the Akita Yurihonjo Offshore Wind Project stands as a landmark initiative in the country’s renewable energy transition. With a planned capacity of 845 MW, this large-scale fixed-bottom offshore wind farm will significantly contribute to Japan’s goal of 10 GW by 2030 and 30-45 GW by 2040.

Developed by Akita Yurihonjo Offshore Wind LLC, the project integrates cutting-edge technology, strategic supply chain partnerships, and a strong commitment to regional economic revitalization. In this post, we’ll explore the project details, investment potential, economic impact, and challenges shaping this major offshore wind initiative.

➡ For an overview of all ten Promotion Areas as of 2025, see:

Promotion Areas for Offshore Wind in Japan – 2025 Overview

1. Project Overview

| Project name | Akita Yurihonjo Offshore Wind |

| Developer | Akita Yurihonjo Offshore Wind LLC |

| Partners | Mitsubishi Corporation Offshore Wind Ltd. C-TECH CORPORATION Venti Japan Inc. Mitsubishi Corporation |

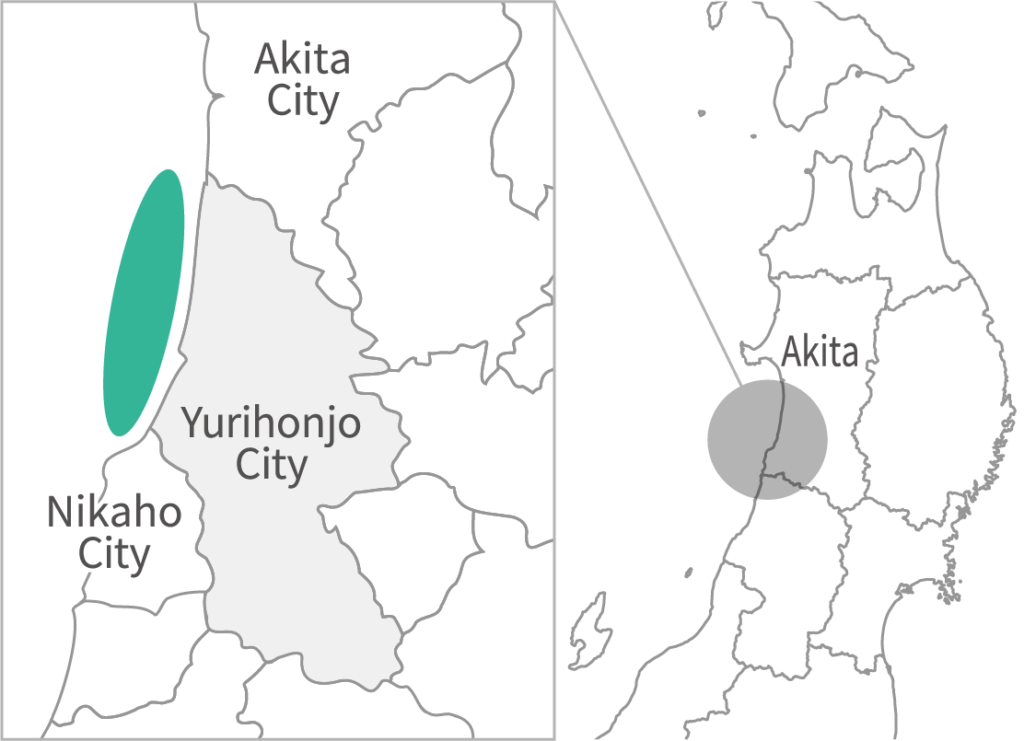

| Location | Offshore Yurihonjo City, AKITA Prefecture |

| Type | Fixed-bottom Offshore Wind Power |

| WTG | GE |

| Price | 11.99 JPY/kWh |

| Capacity | 845 MW (13 MW × 65 turbines) |

| Start of Construction | March 2026 (onshore), April 2029 (offshore) |

| Operation Period | DeDecember 2030 – March 2052 |

2. Location

2-1. Sea & Geographical Features

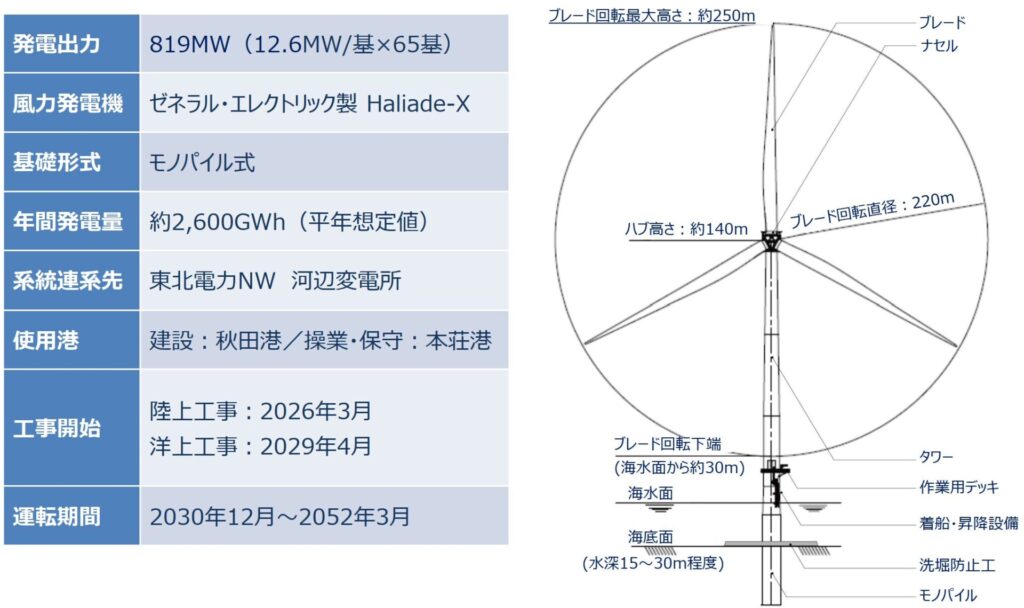

The sea area is approximately 13,040 ha, and the water depth is approximately 15 to 30 m. The average wind speed is high, and GE’s Haliade-X 13 MW large wind turbines will be used.

2-2. Port Infrastructure & Grid Connection

The plant will be based at Akita Port during construction and Honjo Port during operation and maintenance. It is planned to be connected to the Tohoku Electric Power Network’s Kawabe substation.

3. Overview of Wind Turbine Facilities

4. Project Timeline & Development Phases

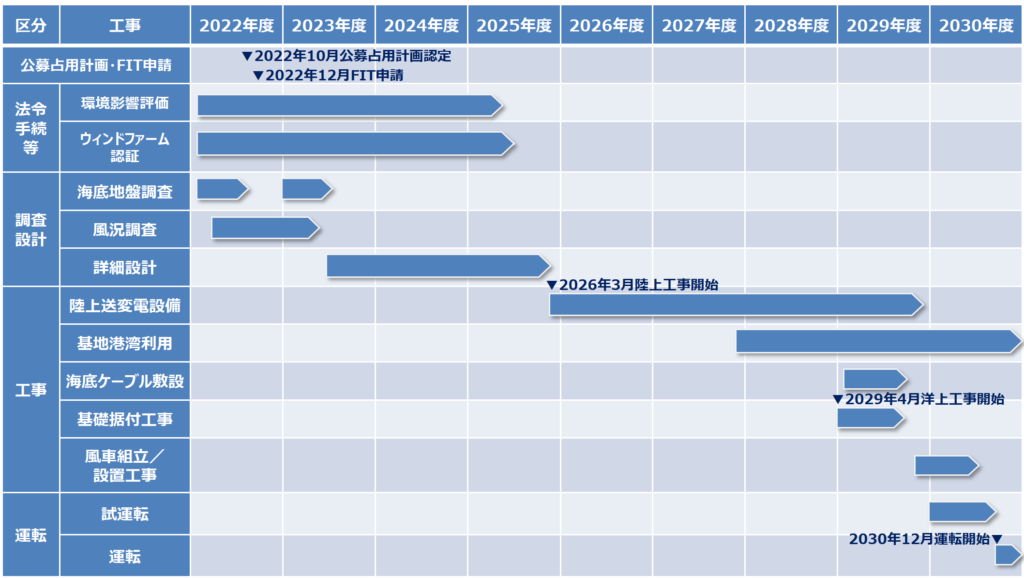

The Akita Yurihonjo project follows a structured 4-phase development approach:

1️⃣ Development Phase (2021-2026)

- December 2021: Public auction awarded

- Environmental impact assessment (EIA), seabed surveys, wind measurements

- Grid connection approvals & supply chain planning

- Stakeholder engagement with local fishing industries & communities

2️⃣ Construction Phase (2026-2030)

- March 2026: Onshore substation & transmission infrastructure

- April 2029: Offshore foundation & cable installation

- 2029-2030: Wind turbine assembly, installation & commissioning

3️⃣ Operation & Maintenance (2030-2052)

- GE and local partners to manage long-term O&M (Operations & Maintenance)

- Maintenance hub set at Honjo Port

4️⃣ Decommissioning & Repowering (2052 onwards)

- End-of-life planning, potential repowering with next-gen turbines

EIA status

| Prefecture | Project name | Developer | EIA Stage | Project Scale | Last updated |

|---|---|---|---|---|---|

| Akita | (Tentative name) Offshore Wind Power Project off Yurihonjo City, Akita Prefecture | Akita Yurihonjo Offshore Wind GK | Project Terminated | Up to 838.2 MW (9.525 MW × 88 turbines) | Feb 21, 2023 |

| Akita | (Tentative name) Offshore Wind Farm Project off Yurihonjo City, Akita Prefecture | Akita Yurihonjo Offshore Wind Energy Co., Ltd. | Project Terminated | Output: 730 MW; 67 turbines rated at 11 MW each | Feb 21, 2023 |

| Akita | (Tentative name) Offshore Wind Power Project off Yurihonjo City, Akita Prefecture | Akita Yurihonjo Offshore Wind GK | Environmental Impact Assessment Method Statement | Total output: up to 910 MW; per-turbine output: 12.6–14 MW class; 65 turbines | Dec 6, 2022 |

| Akita | (Tentative name) Yurihonjo Offshore Wind Power Project | Japan Wind Development Co., Ltd. | Environmental Impact Assessment Method Statement | Up to 780 MW (subject to adjustment); per-turbine output: 9.5–12 MW class; 65–83 turbines | Jun 29, 2021 |

5. Local Coordination Status

A legally mandated council has already been established. Coordination with local fishery stakeholders is ongoing, and a six-year fisheries impact assessment is planned from pre-construction to post-operation. It has been agreed that 0.5% of electricity sales revenue will be contributed to a fund for regional benefit.

6. Reviewing the Business Plan from Scratch?

Mitsubishi Corporation announced that it had recorded an impairment loss of 52.2 billion yen for the April–December 2024 period due to a reassessment of its three domestic offshore wind projects. At a press conference, President Katsuya Nakanishi stated, “We take the impairment seriously” and indicated that the company will reconsider its future business policy from scratch.

6-1. Causes of the Impairment and Future Policy

Mitsubishi Corporation won bids for three projects in 2021 and has been developing them for about three years. However, due to global inflation, yen depreciation, and rising interest rates, project costs significantly exceeded expectations. As a result, the company is reassessing profitability, with a final decision on whether to continue the projects to be made in the future.

The company also explained that nearly all recorded assets have been written off, and although further impairment losses may occur, the impact would be limited.

6-2. Breakdown of the Impairment Loss

Expenses related to surveys, design, and permitting had been recorded as assets but are now entirely written off. The total of already-paid expenses and expected future costs amounts to 52.2 billion yen.

6-3. About the Bid Pricing

In the 2021 auction, Mitsubishi Corporation won the projects with significantly lower bids than its competitors. The company explained that the decision was based on risk analysis using the expertise of Eneco. However, higher-than-expected inflation and cost increases greatly impacted the projects’ profitability.

6-4. Future of the Offshore Wind Business

Mitsubishi Corporation recognizes offshore wind as a key power source for a decarbonized society. Going forward, it intends to carefully assess its business strategy in light of inflation, interest rates, and currency trends.

7. Mitsubishi-led Consortium to Exit Three Offshore Wind Projects in Japan-Aug 26th

Mitsubishi Corporation and partners are preparing to withdraw from offshore wind projects across three sites off Chiba and Akita prefectures.

7-1. Why Exit?

- Ultra-low bid prices during the auction

- Rising material and construction costs

- Projects deemed no longer economically viable

This marks a major setback for Japan’s flagship renewable energy program.

Re-tendering is expected, but the withdrawal highlights the challenges of balancing cost-competitive auctions with the realities of supply chain inflation and project financing.

7-2. Implications

- Japan’s offshore wind strategy may face a significant review

- Timeline pressure toward the 2030 (10 GW) and 2040 (30–45 GW) national targets increases

- Investor confidence hinges on how the government resets its renewable energy policy

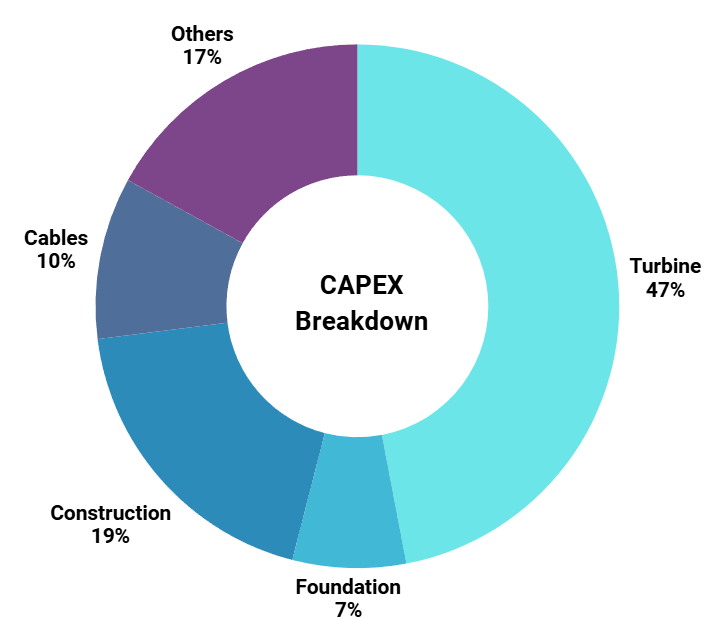

8. CAPEX, OPEX, LCOE and IRR Estimates

Evaluating the profitability of offshore wind projects requires close attention to cost-related indicators such as CAPEX, OPEX, LCOE, and IRR. However, in Japan’s designated Promotion Zones, publicly available cost data remain scarce, leaving investors and developers with limited information for decision-making.

To address this, we estimated CAPEX, OPEX, LCOE, and IRR using the NEDO cost model, based on representative site conditions including distance to shore, water depth, and distance to port.

👉 Read the full article here

Conclusion

The Akita Yurihonjo Offshore Wind Project is a flagship development in Japan’s offshore wind roadmap. With its large-scale capacity (845 MW), advanced technology, and commitment to regional development, it sets a strong precedent for future offshore wind investments.

As Japan accelerates offshore wind growth, this project will play a critical role in decarbonization, energy security, and industrial revitalization. Investors and stakeholders should watch closely as this project moves from development to construction and operation.

To explore how this area compares nationally and understand Japan’s offshore wind roadmap, visit:

Promotion Areas for Offshore Wind in Japan – 2025 Overview —

your guide to Japan’s offshore wind Promotion Areas.

Japan’s offshore wind is no longer constrained by ambition — but by viability.📘 DeepWind Premium Report

A decision-oriented report synthesizing commercial viability, cost/revenue misalignment, supply-chain constraints, and Round 4 implications.

View the report (Gumroad)

- 🔍Market Insights – Understand the latest trends and key topics in Japan’s offshore wind market

- 🏛️Policy & Regulations – Explore Japan’s legal frameworks, auction systems, and designated promotion zones.

- 🌊Projects – Get an overview of offshore wind projects across Japan’s coastal regions.

- 🛠️Technology & Innovation – Discover the latest technologies and innovations shaping Japan’s offshore wind sector.

- 💡Cost Analysis – Dive into Japan-specific LCOE insights and offshore wind cost structures.