Contents

ToggleIntroduction

Japan’s offshore wind sector is evolving rapidly, with strict selection criteria for project developers to ensure efficiency, sustainability, and economic benefits. This post breaks down the evaluation process for selecting offshore wind project operators under Japan’s regulatory framework.

While this article focuses on a specific topic, those looking to understand Japan’s overall offshore wind policy and regulatory framework should also read our comprehensive summary here:

1. Key Evaluation Criteria for Offshore Wind Project Selection

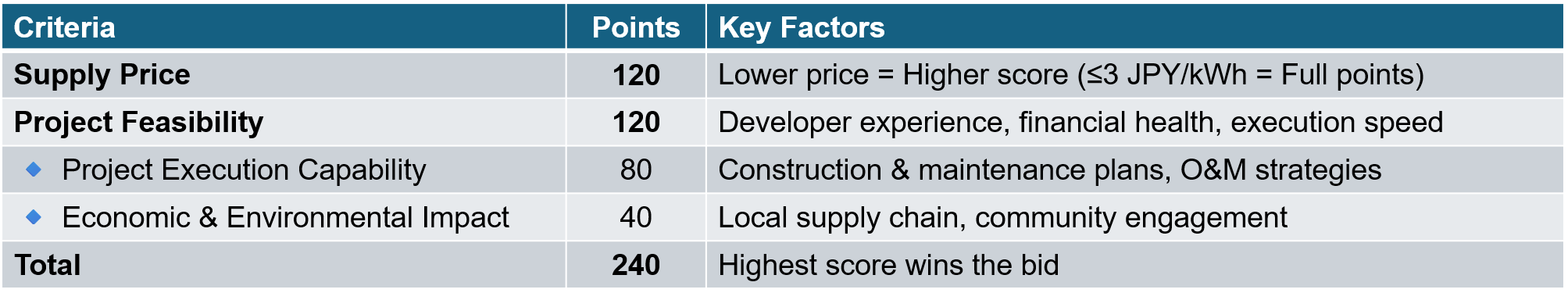

Japan’s offshore wind project selection process scores applications on a 240-point scale, focusing on two main factors:

1️⃣ Supply Price (120 points) – Lowest electricity price per kWh.

2️⃣ Project Feasibility (120 points) – Developer capability, financial stability, risk management, and local economic impact.

2. Supply Price 120pt

In Japan’s offshore wind project selection process, supply price (bid price per kWh) plays a crucial role. Developers are awarded up to 120 points based on their bid price, with lower prices receiving higher scores.

2-1. Supply Price Scoring System

The supply price score is calculated using the following formula:

Supply Price Score = (Lowest Bid Price) / (Bid Price Submitted by the Developer) × 120

✅ The lowest bid price among all bidders in the same offshore wind auction area is used as the reference.

✅ If a developer submits a price at or below the Zero Premium Level (ZPL), they automatically receive the full 120 points.

2-2. Key Rules for Supply Price Evaluation

(1) If the Lowest Bid Price is Above ZPL:

- The lowest price in the auction determines the reference price for scoring.

- Higher bid prices result in lower scores.

Example: Scoring Based on Supply Price (Above ZPL)

| Developer | Bid Price (JPY/kWh) | Score Calculation | Final Score |

|---|---|---|---|

| Company A (Lowest Price) | 4.0 | (4.0 / 4.0) × 120 | 120 |

| Company B | 4.5 | (4.0 / 4.5) × 120 | 106.7 |

| Company C | 5.0 | (4.0 / 5.0) × 120 | 96.0 |

(2) If the Lowest Bid Price is Below ZPL

- If any developer submits a price below ZPL (3 JPY/kWh in this auction), all scores will be calculated using ZPL as the reference price instead of the lowest bid price.

- Developers bidding at or below ZPL automatically receive 120 points.

Example: Scoring Based on Supply Price (Below ZPL)

| Developer | Bid Price (JPY/kWh) | Score Calculation | Final Score |

|---|---|---|---|

| Company A (Below ZPL) | 2.8 | Automatic | 120 |

| Company B (ZPL Level) | 3.0 | Automatic | 120 |

| Company C | 3.5 | (3.0 / 3.5) × 120 | 102.8 |

| Company D | 4.0 | (3.0 / 4.0) × 120 | 90.0 |

3. Project Feasibility 120pt

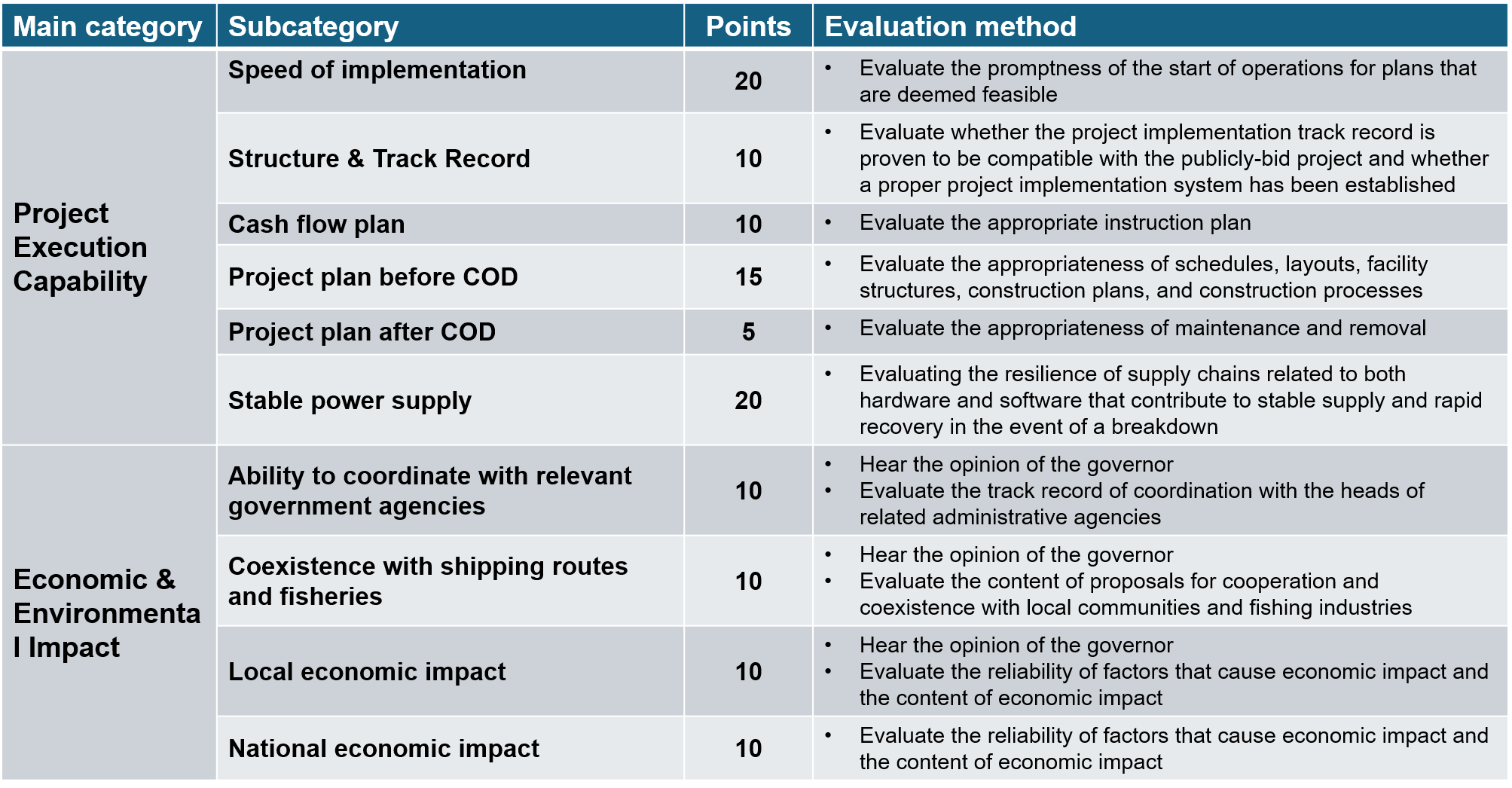

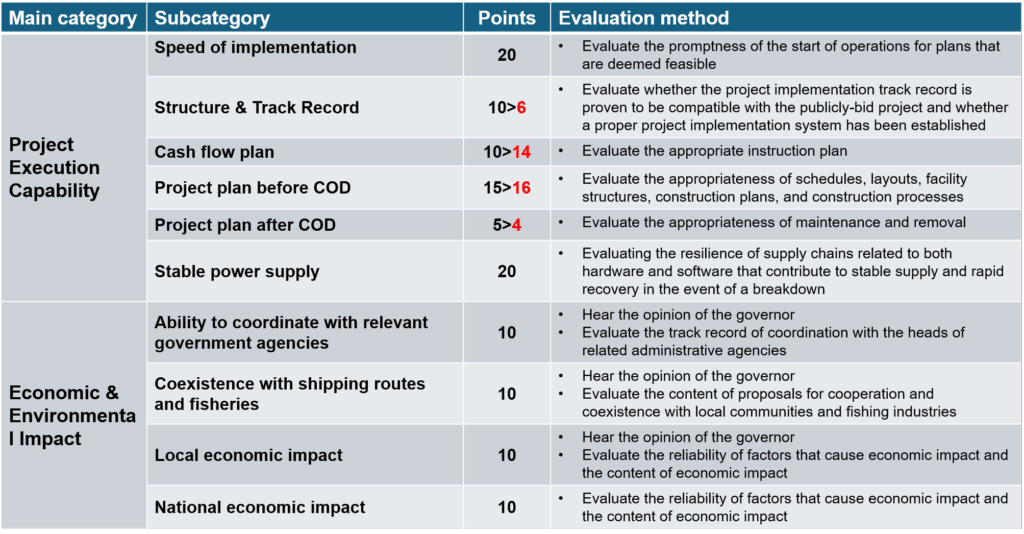

The specific method for confirming each item regarding project feasibility is as follows.

3-1. Project Feasibility Scoring System

1️⃣ Five-tier grading system:

Projects are assessed using five rating levels plus a disqualification category:

- Top Runner (100%)

- Excellent (75%)

- Middle Runner (50%)

- Good (25%)

- Minimum Required Level (0%)

- Disqualified

2️⃣ Scoring distribution:

Each evaluation item is scored based on the highest-rated project in the same offshore wind auction area.

3️⃣ Speed of project implementation:

This is evaluated separately based on predefined criteria.

4️⃣ Final Feasibility Score Calculation:

Based on the total score of each evaluation item, the business feasibility evaluation score is calculated using the following formula.

Feasibility Score = (Bidder’s Score) / (Highest Score in the Auction Area) × 120 [full marks]

✅ The highest-scoring bidder in the auction area is used as the reference point (120 points).

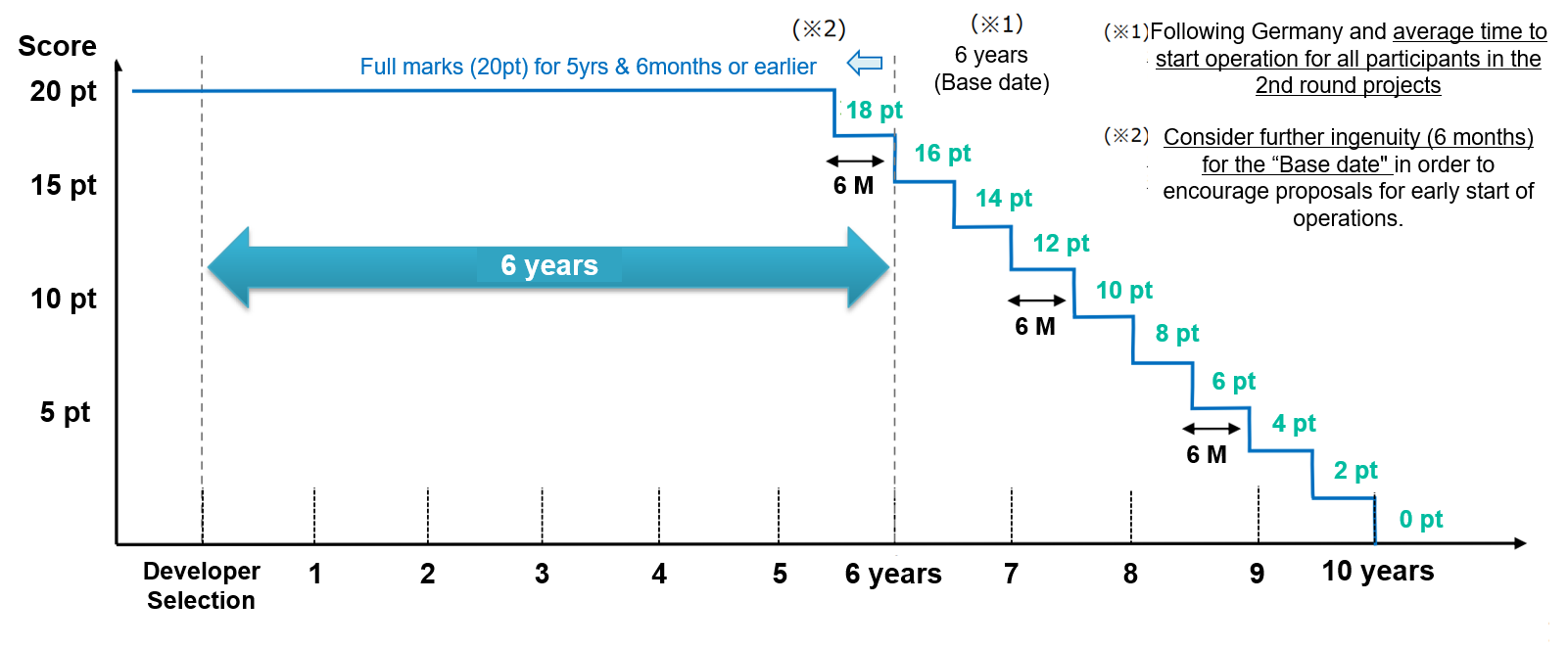

3-2. Speed of implementation Scoring System

✅ The base date will be approximately 6 years, which is the average period until the start of operations for all participants in the second public offering, and the maximum score (20 pt) will be 5 years and 6 months, which takes into account further ingenuity by operators (6 months).

✅ Regarding the width of the steps (period) and the point difference for each step, 2 points will be deducted every 6 months.

Conclusion

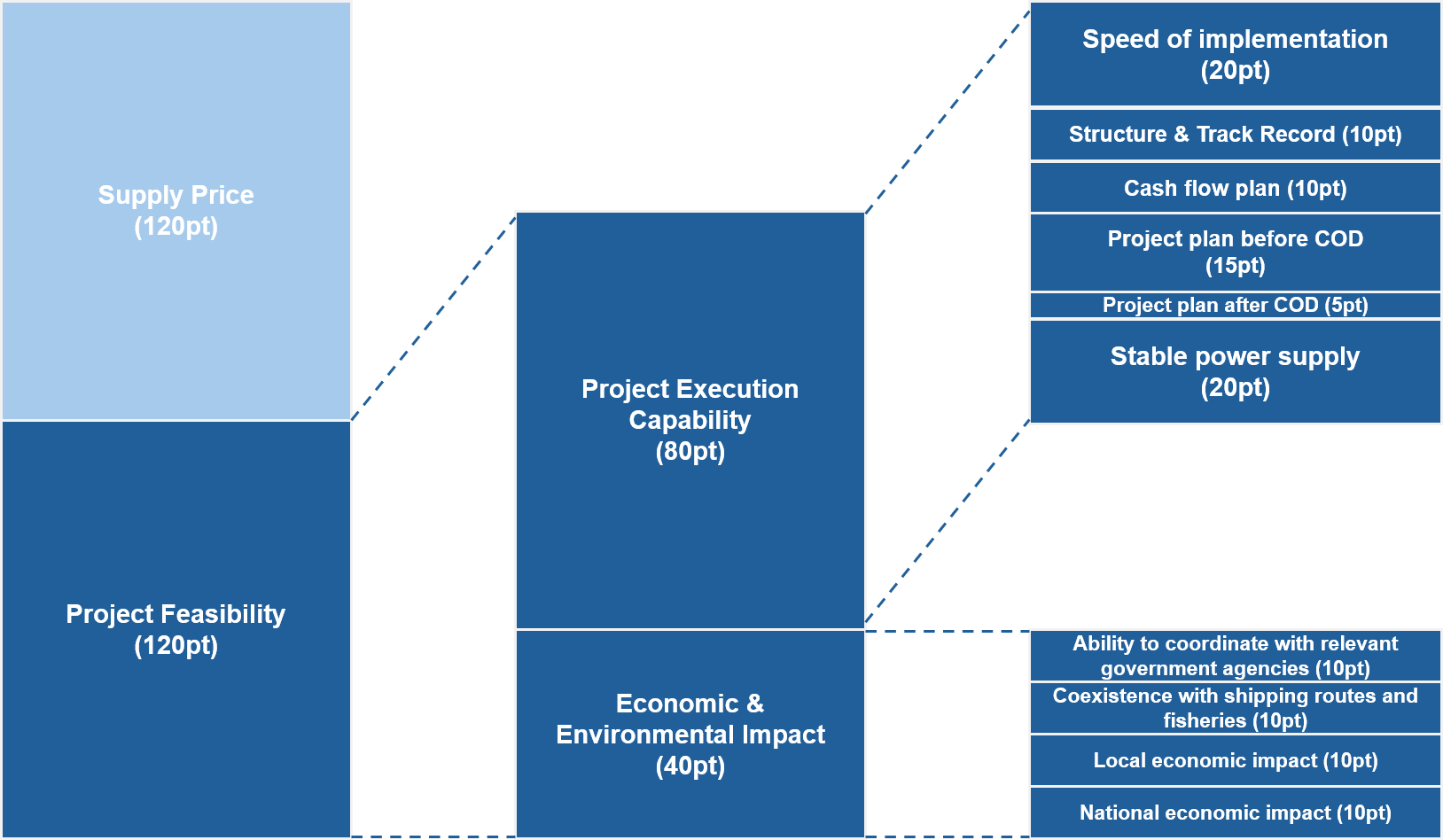

In Japan’s offshore wind project tender process, project developers are evaluated comprehensively based on two main factors: the supply price and the feasibility of project execution. The project feasibility score (out of 120 points) is further divided into two components: Project Execution Capability (80 points) and Economic & Environmental Impact (40 points), with detailed subcategories assigned specific weights.

In terms of execution capability, priority is given to early operational startup, financing plans, construction and decommissioning strategies, and the robustness of the stable power supply system. In the latest revision, scores for implementation structure and decommissioning plans have been slightly reduced, while greater emphasis has been placed on financing and pre-construction plans.

Meanwhile, the economic and environmental evaluation focuses on the developer’s ability to coordinate with local governments and fisheries, as well as the broader economic impact on both local and national levels. Emphasis is placed on coexistence with local communities and contributing to regional development.

This scoring framework reflects not only quantitative price competition but also long-term execution capability and regional contribution, forming a vital mechanism to ensure the sustainable development of offshore wind power in Japan.

For a broader understanding of Japan’s offshore wind legal system, policy structure, and support measures, be sure to check out our pillar article:

Round 4 Is Not a Reset.📘 DeepWind Premium Report

A concise, decision-oriented structural brief on what actually changed —

and what remains structurally broken.

Market Insights – Explore global and Japanese market trends

Policy & Regulations – Understand government policies and auction schemes

Projects – Case studies of offshore wind projects worldwide

Technology & Innovation – Dive into floating technology advancements

Cost Analysis – Learn about LCOE and offshore wind project costs