Introduction

Japan’s offshore wind sector is often described as one of the fastest-moving policy-driven markets globally. In a relatively short period, the government set long-term capacity targets for 2030 and 2040, established a dedicated legal framework for sea area use, introduced auctions supported by government-led preparation, and transitioned revenue support from FIT to FIP—many of the elements that appear necessary for project formation seem to be in place.

In practice, however, the market has also experienced delays after auction awards, project withdrawals, and repeated schedule revisions. As these developments accumulated, a question became increasingly difficult to ignore among market participants: if the framework looks largely established, why does execution remain challenging?

This cannot be explained solely by isolated project failures or short-term cost spikes. It is more useful to view the situation as a structural issue: how the policy and regulatory framework is designed, what assumptions it relies on, what it is intended to cover, and what is deliberately left to market forces and project-level decisions.

This article organizes Japan’s offshore wind policy and regulatory framework not as a simple list of rules, but as a system that shapes execution conditions. It reviews the policy signals embedded in capacity targets and the Strategic Energy Plan, the design logic of the Marine Renewable Energy Act and area designation, how auction format and evaluation criteria shape the nature of competition, how revenue schemes (FIT/FIP) relate to complementary mechanisms such as the long-term decarbonization auction, and emerging topics including EEZ expansion and certification requirements.

The key is not to judge whether these policies are right or wrong. What matters is understanding under what conditions the framework supports execution—and under what conditions its limits become visible. The goal is not “knowing the rules” for its own sake, but being able to interpret where risks sit and what factors can shape project delivery. This article aims to provide that high-level map.

From the perspective of international developers and investors, Japan is often seen as a market where the policy and regulatory framework was established early. Targets, laws, and auction procedures are relatively well-defined. At the same time, execution-stage conditions vary significantly by project, and important practical factors are not always fully captured in policy documents alone.

For that reason, assessing Japan’s offshore wind market requires more than reading individual rules. It requires understanding the assumptions behind the framework and how different actors may interpret it. The same framework can imply different decision points depending on whether the reader is a developer, supplier, lender, or public stakeholder.

This article does not aim to evaluate the framework or argue for/against specific measures. Instead, it clarifies what roles policy and regulation are designed to play and what scope they cover, providing a shared baseline for understanding Japan’s offshore wind market.

From an international perspective, Japan is often described as a market where offshore wind policy design is largely “in place.” National targets are clearly articulated, legal frameworks define access to sea areas, and competitive auctions provide a transparent route to project allocation.

At the same time, recent experience has shown that well-defined policy frameworks do not automatically translate into smooth project execution. Delays, schedule revisions, and even project withdrawals have emerged after auctions were completed, raising a recurring question among market participants: where does policy support end, and where does execution risk begin?

This gap is not best understood as a judgment on whether Japan’s offshore wind policy has “succeeded” or “failed.” Rather, it reflects the boundary between what policy frameworks are designed to provide—rules, structure, and predictability—and what remains inherently dependent on market conditions, project-specific assumptions, and execution capacity.

This article is written from that perspective. Instead of assessing individual policies in isolation, it aims to map how Japan’s offshore wind policy framework interacts with real-world project execution, and where its scope deliberately stops.

1. Overall Structure and Current Position of Japan’s Offshore Wind Policy

Chapter focus: This section outlines the top-level policy structure—how targets and strategic planning work as market signals, and how they connect to downstream legal and auction frameworks.

Japan’s offshore wind policy follows a clear structural logic focused on enabling market entry through institutional design. From an early stage, the government adopted a step-by-step approach: setting quantitative capacity targets, establishing a legal framework for sea area use, and introducing competitive auction mechanisms to allocate development rights.

As a result, Japan’s offshore wind market has transitioned from one characterized by high policy uncertainty to one where the participation framework is relatively well defined. This shift has played a critical role in attracting domestic and international developers, suppliers, and financial institutions.

1.1 Policy Signals from the 2030 and 2040 Offshore Wind Targets

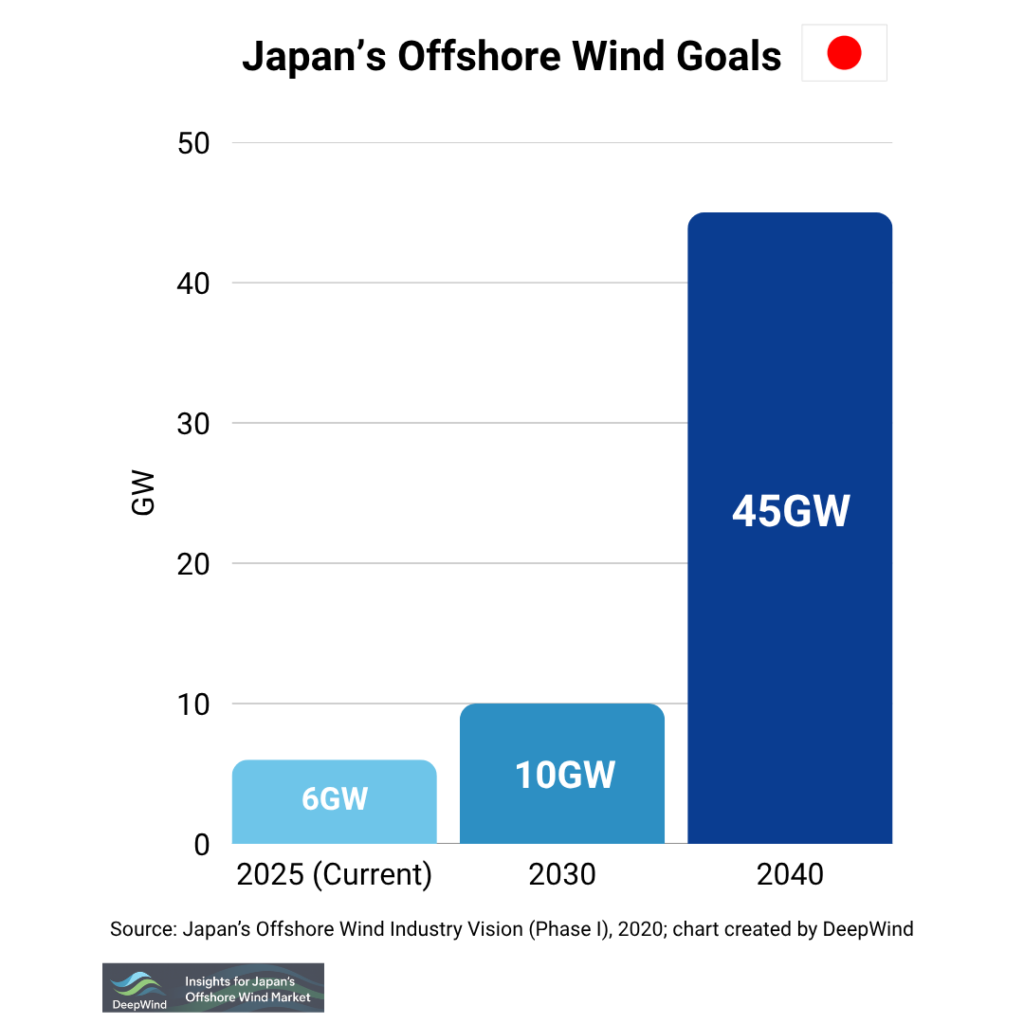

Japan’s offshore wind capacity targets for 2030 and 2040 represent one of the most important policy signals in the market. These figures are not merely indicative contributions to the power mix; they communicate a long-term commitment to positioning offshore wind as a core power source in Japan’s energy transition.

For market participants, these targets have functioned as investment signals. They have helped justify early-stage market entry, supply chain localization, and long-term strategic planning by developers and manufacturers.

For background and context, see: Japan’s Offshore Wind Goals for 2030 & 2040.

1.2 Offshore Wind in Japan’s Strategic Energy Plan

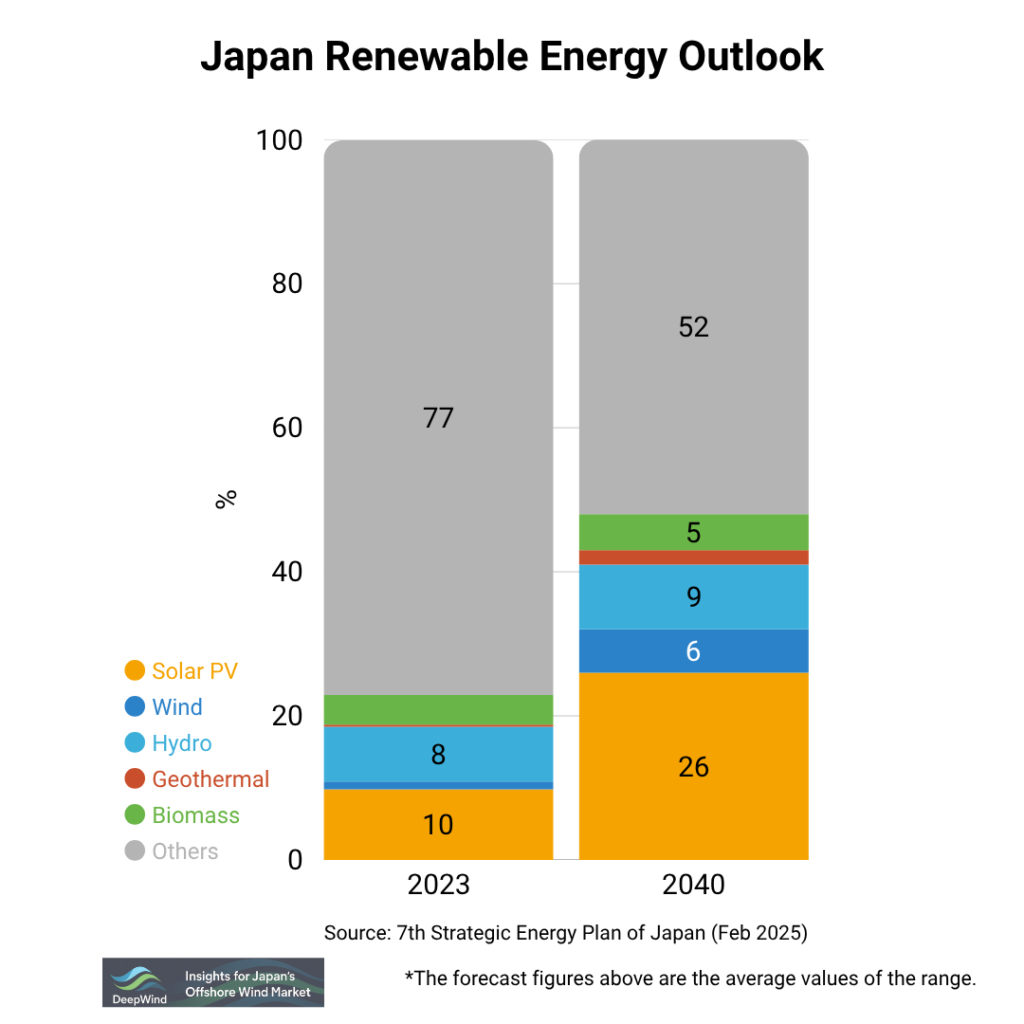

Within Japan’s Strategic Energy Plan, offshore wind has consistently been positioned as a future core power source. Its strategic importance stems from its contribution to decarbonization, energy security, and diversification of domestic power generation.

The Energy Plan functions as a high-level policy framework. Its primary role is to define direction and priority rather than to resolve execution-stage challenges such as cost escalation, supply chain constraints, or project-specific risk allocation.

For a focused summary, see: Japan’s Energy Plan (Strategic Energy Plan) Explained.

Taken together, Japan’s offshore wind policy can be described as ambitious yet deliberately segmented. Strategic direction is provided at the national level, while execution feasibility is determined through a combination of legal processes, auctions, revenue schemes, and market conditions. The next chapter examines the Marine Renewable Energy Act, which forms the institutional backbone of Japan’s offshore wind framework.

2. The Marine Renewable Energy Act as the Institutional Backbone

Chapter focus: This section explains the core legal framework that enables long-term sea area use for offshore wind, and why area designation matters for project development.

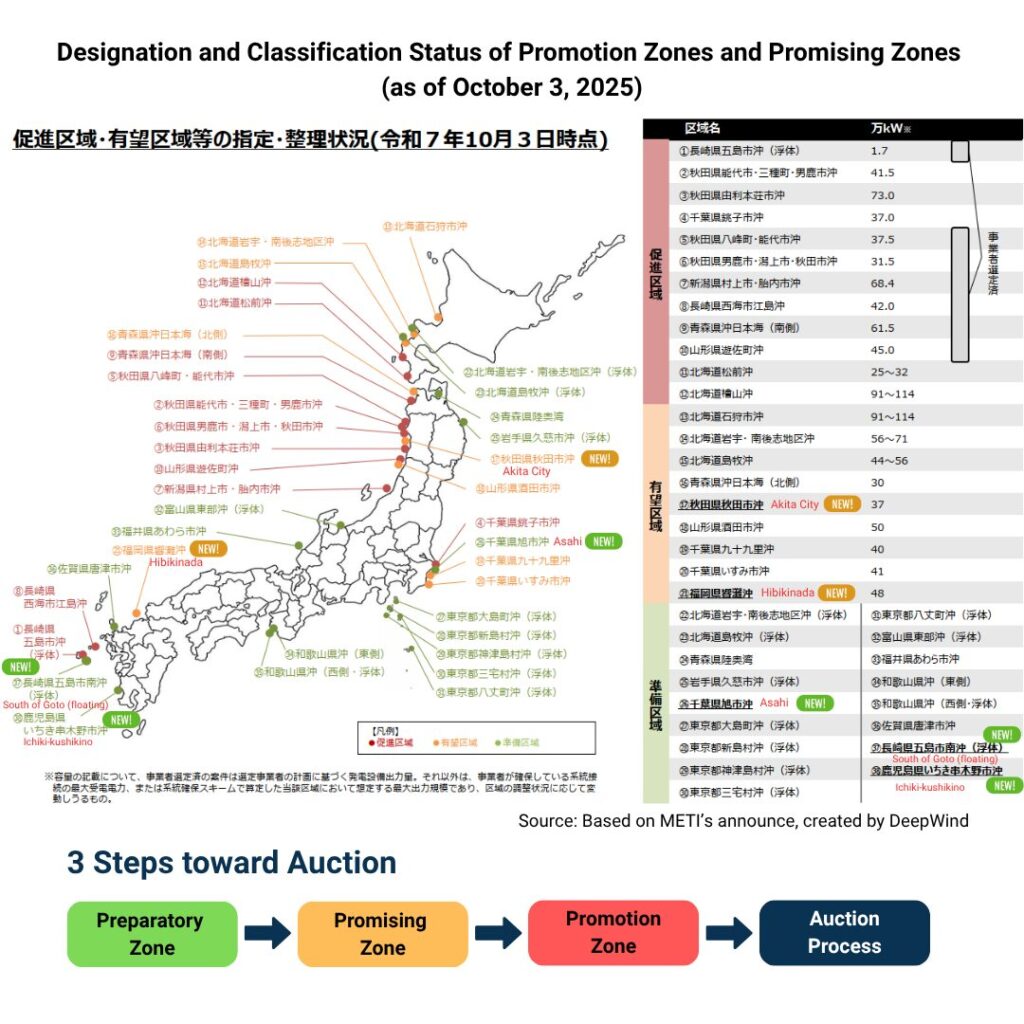

This figure illustrates the institutional process for Japan’s offshore wind projects—from area preparation and designation through competitive selection and the steps leading into implementation. While the procedures are structured in stages, it also implies that what developers are expected to plan, document, and take responsibility for can differ significantly across phases.

Clear procedural definition is one of the strengths of Japan’s framework. At the same time, the practical boundary of developer responsibilities at each step is not always fully apparent from policy documents alone, which is why execution planning often requires careful interpretation beyond the formal process map.

The cornerstone of Japan’s offshore wind framework is the Marine Renewable Energy Act, which provides the statutory basis to enable long-term and (in practical terms) exclusive use of designated sea areas for offshore wind projects. By clarifying sea area use rights and formalizing selection procedures, the Act established the legal conditions needed for long-horizon private investment.

In other words, the Act raises offshore development in public waters to a level of procedural predictability that makes large-scale project planning feasible: it clarifies government roles, defines the project selection process, and supports long-term occupation arrangements consistent with international offshore wind practice.

Deep dive article: Japan’s Offshore Wind Legal Framework: The Marine Renewable Energy Act.

2.1 Design Logic: What the Act Is Designed to Provide

The design logic is straightforward: government-led area preparation reduces uncertainty around site availability and procedures; competitive selection allocates development rights; and long-term occupation arrangements support the investment time horizon typical for offshore wind.

At the same time, the Act’s role is primarily to establish access and procedural certainty. It does not, by itself, resolve execution-stage conditions such as supply capacity, construction constraints, financing terms, or cost volatility. Those elements sit largely outside the legal framework and are shaped by downstream mechanisms and market conditions.

2.2 Area Designation: Promotion Areas and the Practical Meaning of “Being Designated”

Under the Marine Renewable Energy Act, sea areas progress through stages of preparation before being designated as auction-eligible Promotion Areas. Earlier-stage classifications (often discussed as preparation or promising stages) support stakeholder alignment and procedural readiness before formal designation.

From a market perspective, designation is best understood as the start of competition rather than an assurance of project viability. Once an area becomes auction-eligible, the key differentiators shift toward bid competitiveness, deliverability assumptions, and execution readiness—factors that are not determined by designation alone.

The next chapter explains how Japan’s auction framework sits on top of this legal backbone and how competition is structured in practice.

3. Auction Framework and Competition Design

Chapter focus: This section explains how Japan selects developers for Promotion Areas, with emphasis on the centralized method and the scoring-based evaluation approach.

With the Marine Renewable Energy Act establishing the legal backbone for sea area use, Japan’s offshore wind sector effectively entered a stage where projects could be formed through a defined process. The next step was the auction framework—how development rights are allocated, and under what conditions.

Importantly, auctions are not only a mechanism for selecting winners. The way competition is designed—what is evaluated, how points are awarded, and what assumptions are embedded—can influence developer behavior, risk-taking, and the stability of post-award execution plans. This chapter reviews how Japan’s auction framework evolved and highlights the structural effects that emerged alongside competition.

Once the legal backbone for sea area use was established, the next step was designing a mechanism to allocate development rights—Japan’s offshore wind auction framework. Auctions do more than select winners; the structure of competition (what is evaluated, and how) shapes developer behavior, project assumptions, and delivery planning.

3.1 The Centralized Method: Government-Led Preparation Before Auctions

The centralized method represents a major turning point in Japan’s offshore wind auction design. By conducting key surveys and preparatory work on the government side and then running auctions based on a standardized information set, the method aims to reduce early-stage uncertainty and lower barriers to entry.

It is important to note that the centralized approach does not remove execution risk from offshore wind projects. By standardizing early-stage surveys and reducing initial uncertainty, it shifts the starting point of competition—but it does not eliminate construction risk, supply-chain constraints, or financing challenges.

In practice, centralization changes where risk emerges in the project lifecycle, rather than whether that risk exists at all. As a result, many of the most material uncertainties surface after project selection, during procurement, construction, and grid connection.

Related article: Centralized Method in Japan Offshore Wind: What It Means.

3.2 Scoring and Evaluation Criteria: Beyond Simple Price Competition

Japan’s auctions are structured to evaluate proposals using multiple criteria—not only price but also project plans, local engagement, and implementation capability. The intent is to avoid purely price-driven outcomes and to incorporate broader deliverability and value considerations.

Scoring-based evaluation systems are, by design, tools for comparing plans at a specific point in time. They assess consistency, preparedness, and proposed execution frameworks under a defined set of assumptions.

However, offshore wind projects unfold over long timelines and are exposed to external factors that cannot be fully captured at the bidding stage. Changes in costs, supply availability, or construction conditions can widen the gap between bid-time evaluations and build-time realities, even for projects that performed well under the scoring framework.

Related article: Japan Offshore Wind Scoring System: Project Selection Criteria Explained.

The next chapter turns to the revenue side: how support schemes such as FIT and FIP influence bankability and how complementary mechanisms are being discussed.

4. Revenue Framework: FIT, FIP, and Long-Term Decarbonization Auctions

Chapter focus: This section summarizes how Japan’s revenue support evolved from FIT to FIP and how the long-term decarbonization auction is positioned as a complementary mechanism.

Alongside auction design, revenue stability is one of the most important determinants of offshore wind project development. The core question is how electricity can be sold—at what level of certainty, for what duration, and under which market exposure profile. These parameters influence not only project economics but also lender risk assessment and investment decision-making.

4.1 FIT to FIP: What the Transition Changes at a Framework Level

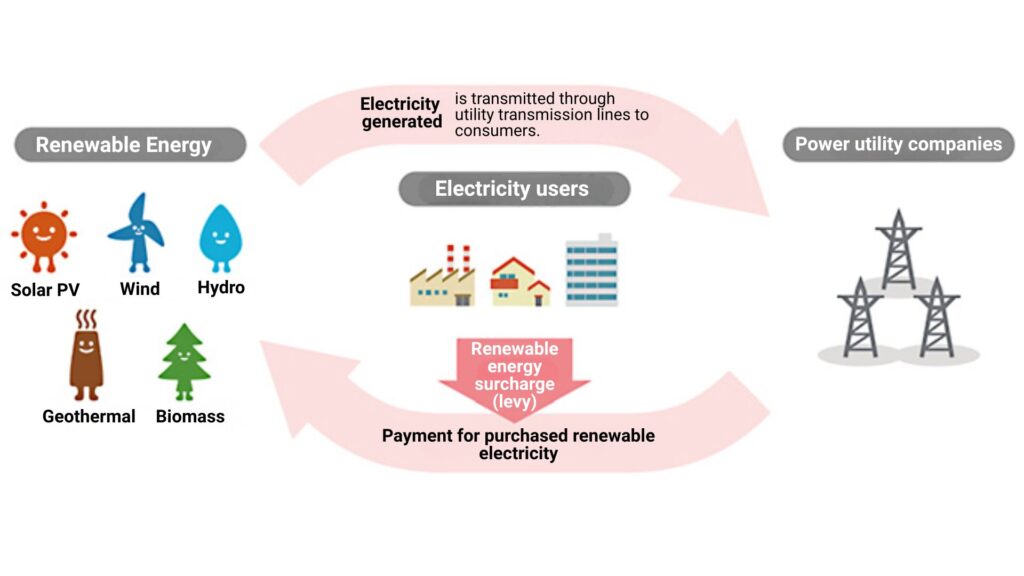

Japan initially used FIT (Feed-in Tariff) to reduce revenue uncertainty and accelerate renewable deployment. As deployment expanded, policy focus increasingly shifted toward market integration and cost discipline. This led to the introduction of FIP (Feed-in Premium), where revenue is linked to market sales with an added premium component.

Related article: FIT vs FIP in Japan: How Renewable Revenue Support Works.

4.2 Long-Term Decarbonization Auctions: A Complementary Mechanism

Another mechanism often discussed in the context of investment certainty is Japan’s long-term decarbonization auction framework, designed to support long-horizon investment in low-carbon power sources by providing additional revenue predictability under defined conditions.

While these revenue mechanisms play an important role in improving long-term cash-flow visibility, they should not be interpreted as guarantees of project executability. Revenue stability addresses one dimension of risk, but it does not resolve uncertainties related to construction timing, cost volatility, or physical execution constraints.

Related article: Japan’s Long-Term Decarbonization Auction (LTDA) Guide.

Next, we move to emerging regulatory topics—EEZ expansion discussions and certification requirements—that affect how the framework may evolve over time.

5. Expanding the Framework: EEZ Discussions and Certification Requirements

Chapter focus: This section introduces two forward-looking topics: legal expansion toward EEZ areas and practical constraints related to technical standards and certification.

5.1 EEZ Expansion: Potential and Practical Considerations

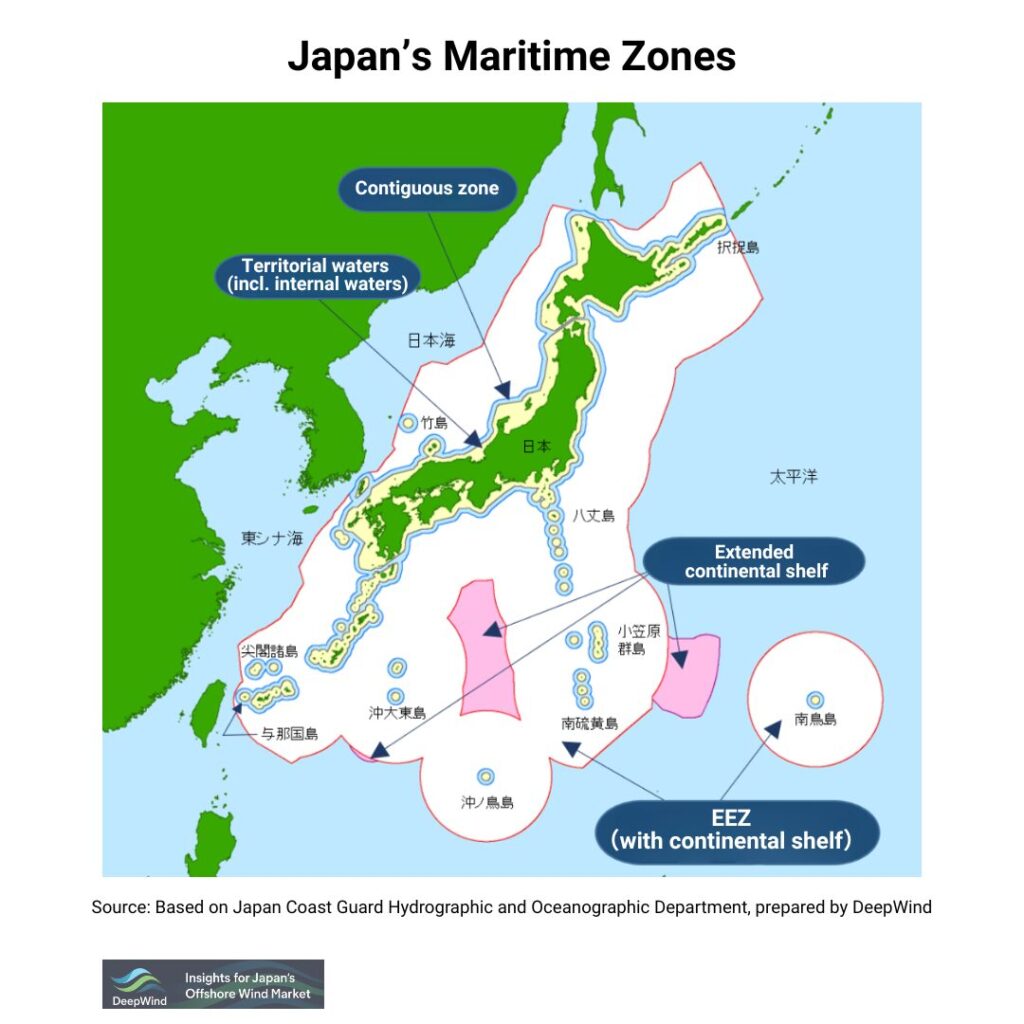

Expanding offshore wind development into Japan’s Exclusive Economic Zone (EEZ) could widen long-term development options and increase theoretical available capacity. At the same time, EEZ projects typically involve different technical and operational premises than nearshore development, including deeper waters, greater reliance on floating technology, and longer logistics and grid connection distances.

For this reason, EEZ expansion is best understood as an option for long-term capacity growth rather than an immediate solution to near-term project pipelines. While the legal discussion expands theoretical potential, practical deployment will depend on technology maturity, logistics feasibility, and grid connection assumptions that extend well beyond existing coastal projects.

Related article: Japan Offshore Wind EEZ Law Revision: What’s Being Discussed.

5.2 Standards, Certification, and Regulatory Practice

Offshore wind is a highly internationalized industry, with many technologies and design practices aligned with global standards. In Japan, project development can also involve domestic legal requirements, safety rules, and certification processes. These factors may influence timelines and execution planning, depending on how they apply to project-specific designs and procurement strategies.

Related article: Japan Offshore Wind: Certification and Regulatory Challenges Explained.

6. From Project Withdrawals to Policy Updates: Key Milestones in Framework Evolution

Chapter focus: This section summarizes key market milestones and related policy updates—without assessing outcomes—highlighting that the framework evolves through implementation experience.

6.1 Round 1 Withdrawals and Government Review

In Round 1, a subset of awarded offshore wind projects later faced significant implementation challenges, resulting in withdrawal decisions in some cases. These events drew attention to post-award processes and the practical conditions that shape delivery planning.

Related article: Round 1 Withdrawals: METI Analysis and Key Takeaways (Fact Summary).

6.2 Auction Framework Adjustments and 2025 Policy Updates

Following these developments, Japan advanced discussions and updates related to auction operation and broader policy measures. These include adjustments aimed at clarifying evaluation approaches and strengthening the overall execution environment as the market matures.

Related articles:

・Japan Offshore Wind Auction Reform (2025)

・Japan Offshore Wind Policy Updates (2025): Integrated Summary

7. What the Policy & Regulatory Framework Covers—and What Sits Beyond It

Chapter focus: This section clarifies the scope of what the framework is designed to provide (rules and predictability) versus external factors that shape execution conditions.

Japan’s offshore wind framework provides essential elements for market participation: policy direction, legal procedures for sea area use, auction-based allocation mechanisms, and revenue-support structures. Together, these elements improve predictability and enable market players to plan within a defined set of rules.

At the same time, offshore wind execution depends on factors that sit beyond any single policy or regulatory framework, including supply availability, construction capacity, cost and financing conditions, grid development, and project-specific site constraints. These factors are shaped by broader market dynamics and project-level decision-making.

For readers, the key takeaway is that understanding the framework is a necessary starting point, but not a complete answer. A practical reading of policy and regulation requires identifying what assumptions the framework relies on and what risks must be evaluated outside the formal rules.

8. Conclusion: How to Use Policy and Regulation as a Decision-Making Tool

This article provided a structured overview of Japan’s offshore wind policy and regulatory framework—covering national targets, the Strategic Energy Plan, the Marine Renewable Energy Act and area designation, auction mechanisms and evaluation criteria, revenue schemes such as FIT and FIP, complementary tools such as long-term decarbonization auctions, and emerging topics including EEZ discussions and certification requirements.

These elements have played an important role in making Japan’s offshore wind market more legible and investable from a rules-and-procedures perspective. At the same time, project execution conditions are shaped by both the framework itself and factors beyond it. For that reason, policy and regulation are best used not as a binary “go/no-go” signal, but as a foundation for identifying assumptions, clarifying responsibilities, and structuring risk assessment.

By understanding what the framework is designed to cover—and what it does not—readers can better interpret market signals, evaluate project conditions, and make more informed decisions in Japan’s offshore wind sector.

What to Watch in Japan’s Offshore Wind Policy Framework

From a framework perspective, several policy-related themes will remain important to monitor as Japan’s offshore wind market continues to evolve.

- How auction rules and evaluation criteria are adjusted through ongoing policy updates and operational experience

- Whether grid readiness and connection assumptions align with the pace of project development

- How effectively policy design remains aligned with execution capacity across the supply chain

These points do not determine project outcomes on their own, but they shape the conditions under which offshore wind projects are planned, financed, and ultimately executed.

📘 DeepWind Premium Report

Japan’s offshore wind is no longer constrained by ambition — but by viability.

A decision-oriented report synthesizing commercial viability, cost/revenue misalignment, supply-chain constraints, and Round 4 implications.

- Commercial viability (CAPEX/OPEX vs revenue)

- Supply-chain & execution constraints

- Round 4 / re-auction implications