Introduction

As Japan accelerates its offshore wind deployment toward its 2050 carbon-neutral goal, understanding the cost structure is crucial. This article provides a detailed overview of offshore wind power costs in Japan—including capital expenditure (Capex), operation & maintenance (O&M), and levelized cost of energy (LCOE)—and compares them to onshore wind, solar PV, and key international markets.

While this article focuses on a specific cost-related aspect, we recommend this summary article for a comprehensive overview of offshore wind cost structure and economic outlook:

👉 Cost Structure and Economics of Offshore Wind

1. Capital Expenditure (CAPEX)

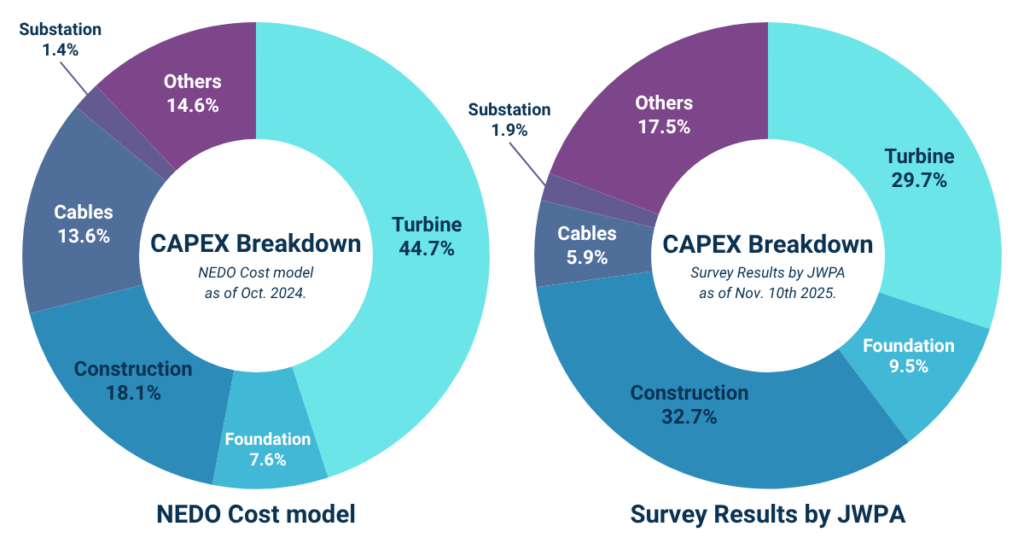

Japan’s offshore wind farms comprise several key components — turbines, foundations, subsea cables, offshore substations, and installation work — with total capital expenditure (CAPEX) estimated at JPY 900,000 per kW as the survey result by JWPA as of Nov. 2025, roughly twice the cost level observed in Europe.

The typical breakdown of initial CAPEX for a monopile foundation project is as follows. (as of Nov. 2025.)

- Turbines: 30%

- Foundations: 10%

- Installation: 33%

- Cables: 6%

- Substation: 2%

- Others: 19%

Among these, installation costs for the largest share (33%), followed by turbine procurement accounts (30%).

Japan’s higher CAPEX compared to overseas markets is generally attributed to the following factors:

Key cost drivers:

- Severe marine conditions requiring designs resistant to typhoons and high waves

- Limited domestic supply chain for large turbines, vessels, and components, leading to import dependence

- With a large number of small-scale projects, achieving economies of scale remains difficult.

2. Operation & Maintenance (O&M)

- O&M Cost

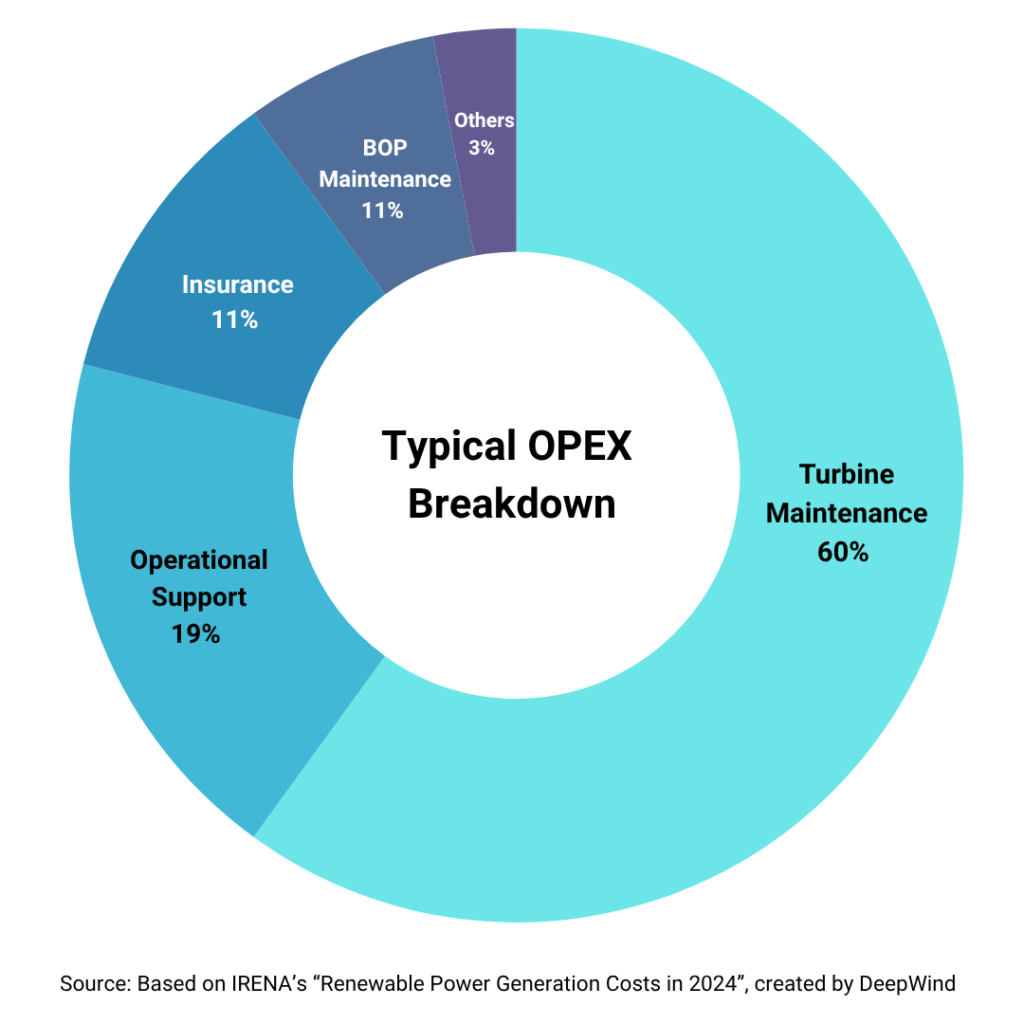

Among these, turbine maintenance typically represents the largest share, accounting for around 60% of total O&M costs. This reflects the need to ensure optimal turbine performance over the project lifetime by regular servicing, repair work and component replacement. Operational support is the second largest cost, accounting for 19% of the total, while insurance costs contribute a further 11%. Balance of plant (BoP) maintenance – which includes marine operations, labour, spare parts, consumables, proactive and reactive O&M and offshore substation O&M – represents around 7%. The remaining 3% falls under “other costs”, which relate to contingencies and expenses associated with wind farm operation (Wood Mackenzie, 2024c). - Floating Wind Premium

Floating turbines face higher O&M costs due to complex access and mooring systems.

3. Transmission Costs

- Offshore Transmission Cables and Grid Reinforcement

Transmitting power from wind-rich regions such as Hokkaido and Tohoku to major demand centers depends heavily on the development of HVDC (High-Voltage Direct Current) networks.

While HVDC enables long-distance transmission with minimal losses, the associated infrastructure costs are enormous, ultimately affecting grid access fees and consumer electricity prices. - Differences in Institutional Design

In Europe, offshore transmission cables are often installed and financed by transmission system operators (TSOs).

In contrast, Japan adopts a model where project developers build the grid connection at their own expense and later transfer the assets to the TSO. - Offshore Deployment Trends

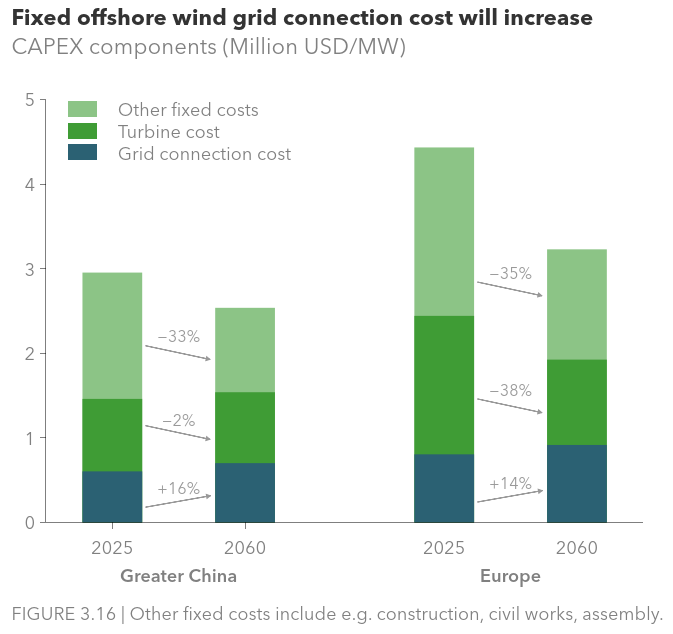

With Japan’s Exclusive Economic Zone (EEZ) now open to floating offshore wind installations, future projects are expected to be located farther from shore, increasing offshore distances.

According to DNV’s Energy Transition Outlook 2025, as wind farms are developed farther offshore, grid connection costs are projected to rise steadily through 2060.

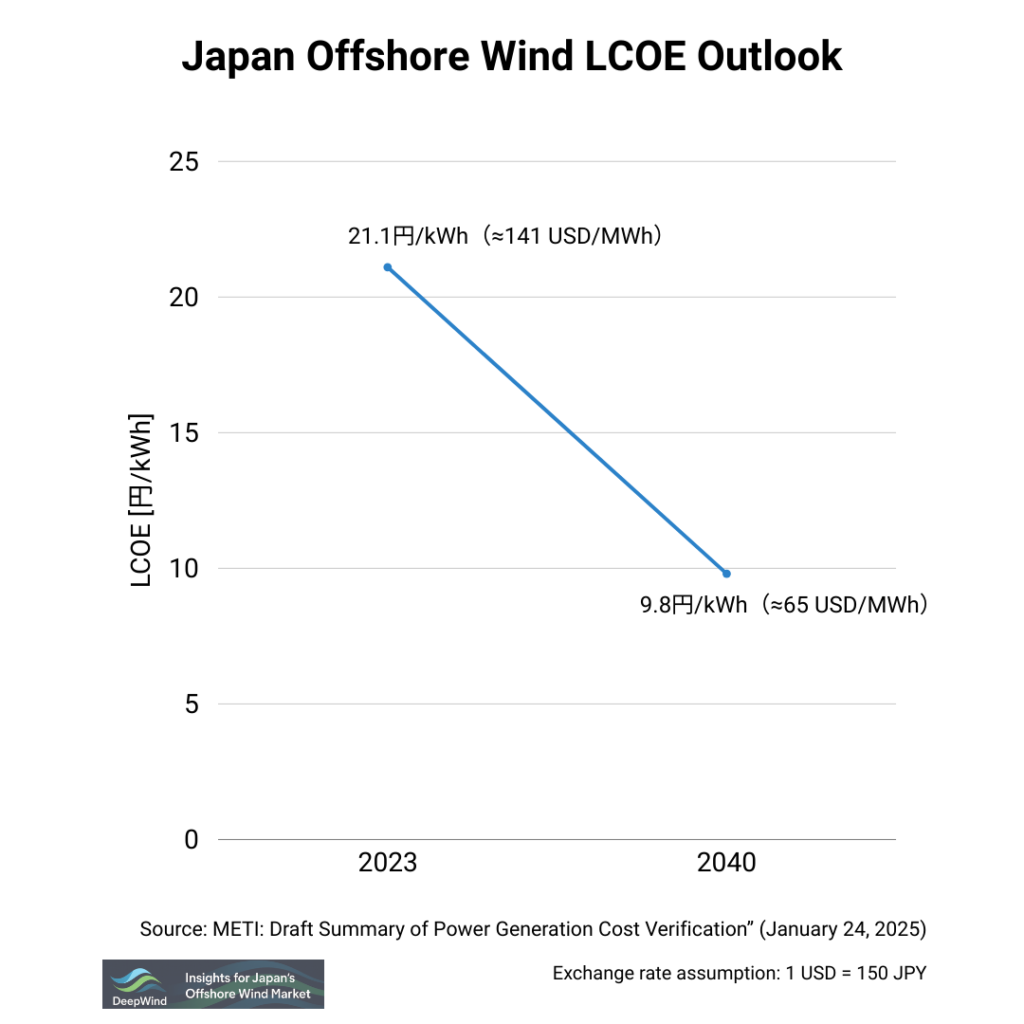

4. Levelized Cost of Energy (LCOE)

- 2023 Baseline: 21.1 JPY/kWh (pure generation cost)

- 2040 Estimates: 9.5 – 10.1 JPY/kWh

- Cost-Reduction Drivers

- Turbine upscaling (from 13 MW to 15/18 MW+)

- Higher capacity factors (from 30% to ~40%)

- Supply-chain maturity & experience curve effects

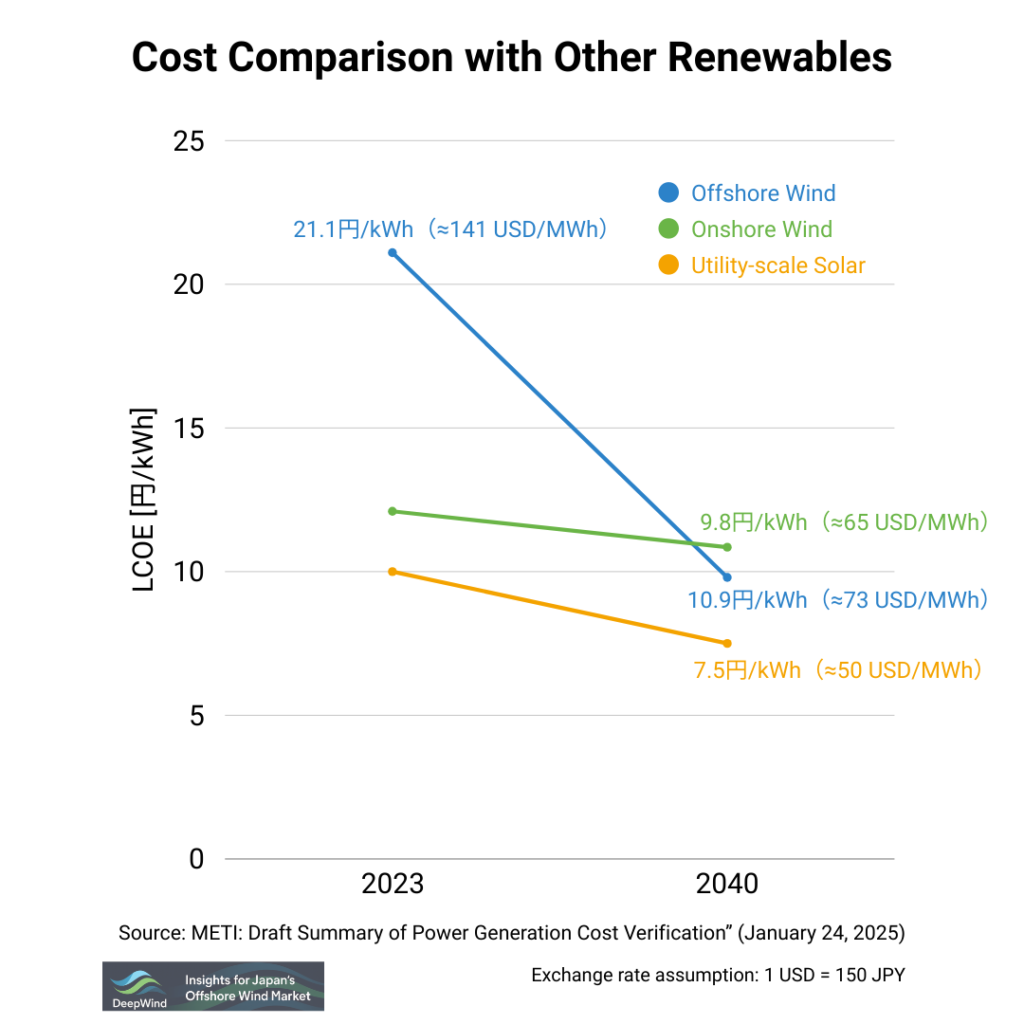

5. Comparison with Other Renewables

| Technology | 2023 LCOE (unsubsidized) | 2040 Outlook |

|---|---|---|

| Offshore Wind | 21.1 JPY/kWh | 9.5 – 10.1 JPY/kWh |

| Onshore Wind | 12.1 JPY/kWh | 10.1 – 11.6 JPY/kWh |

| Solar PV (Utility) | 10.0 JPY/kWh | 6.6 – 8.4 JPY/kWh |

Solar PV and onshore wind currently offer lower generation costs than offshore wind, though each has unique grid-integration and site-specific challenges.

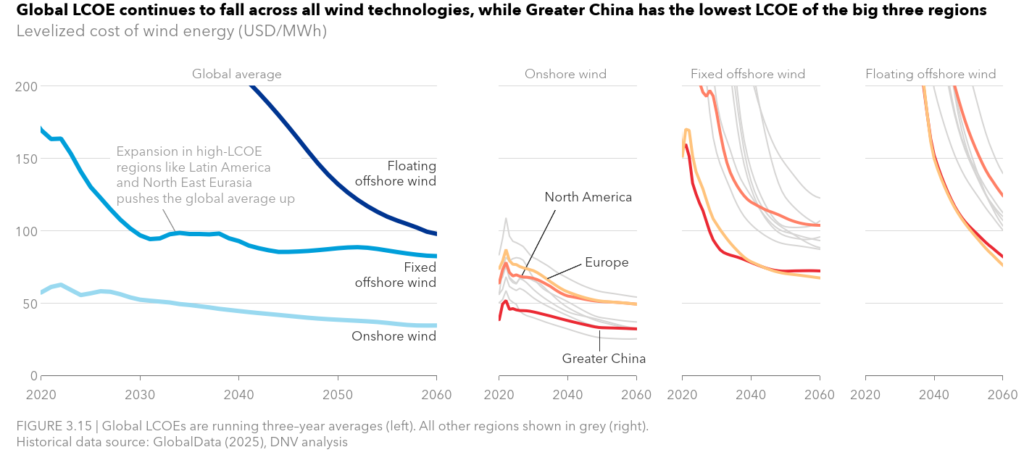

6. Regional Comparison of Wind Power LCOE

In Mainland China, the LCOE of onshore wind remains significantly lower than in Europe and North America.

This is primarily due to excess manufacturing capacity and intense domestic competition, which have led to artificially low turbine prices—levels that are unlikely to be sustainable in the long term.

In addition, China’s mature supply chain and low land and labor costs further contribute to the country’s low LCOE.

In Europe, the LCOE for fixed-bottom offshore wind is projected to reach parity with China by the late 2030s, before declining further toward 2060.

A similar trend is expected for floating offshore wind, though at a slower pace.

In contrast, North America’s LCOE is forecast to remain higher than other regions, as policy uncertainty and temporary project halts are expected to drive up long-term costs.

(Source: DNV, Energy Transition Outlook 2025)

Comparison with Japan

From the DNV chart, comparing Europe’s LCOE with Japan’s, it can be observed that:

- In 2023, Japan’s offshore wind LCOE was about twice as high as Europe’s.

- By 2040, however, Japan is expected to close the gap, with LCOE falling to the ¥9/kWh range, nearly on par with Europe.

| Region | 2023 | 2040 Outlook |

|---|---|---|

| Europe | ~USD 75/MWh ≈ ¥11.3/kWh | ~USD 60/MWh ≈ ¥9/kWh |

| Japan | ¥21-25/kWh | ¥9.5–10.1/kWh |

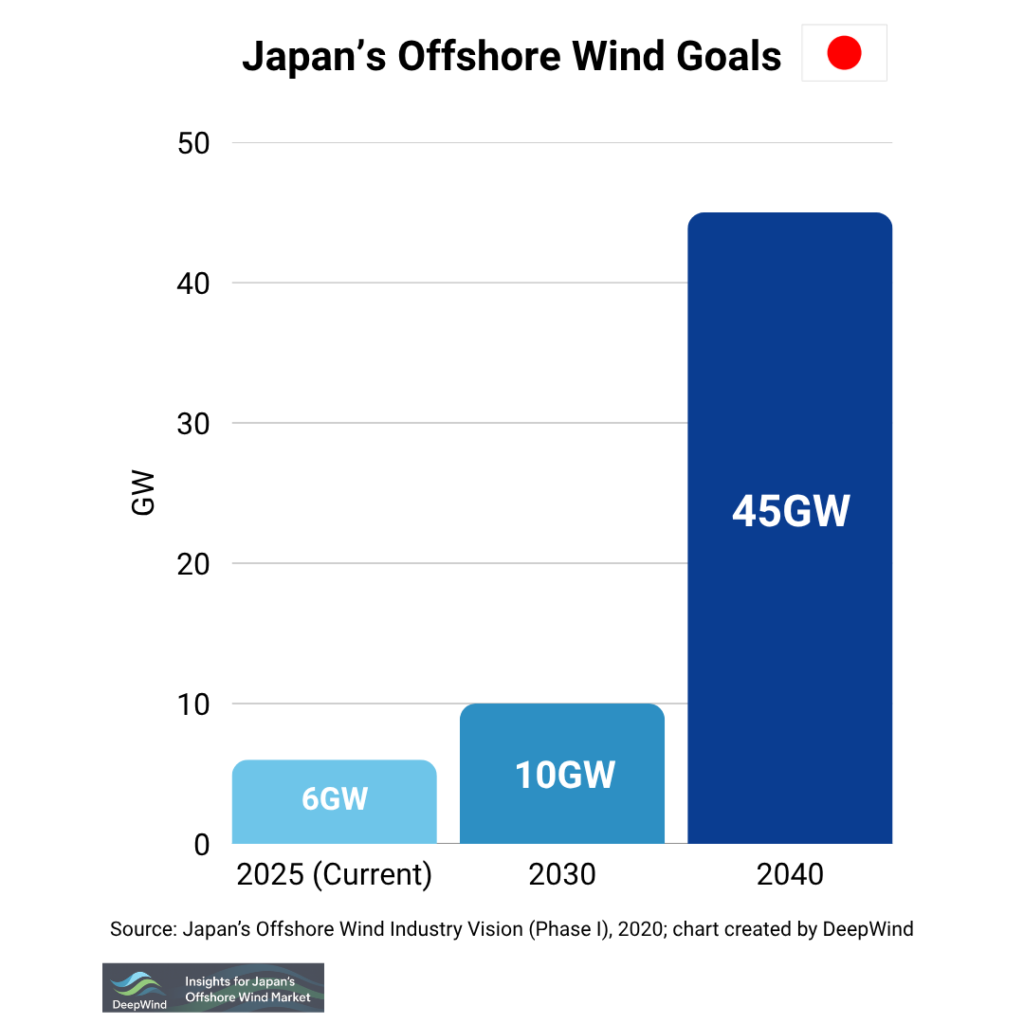

7. Policy Targets & Future Outlook

In the First Offshore Wind Industry Vision announced on December 15, 2020, the Japanese government set targets of achieving a cumulative 10 GW by 2030 and 45 GW by 2040.

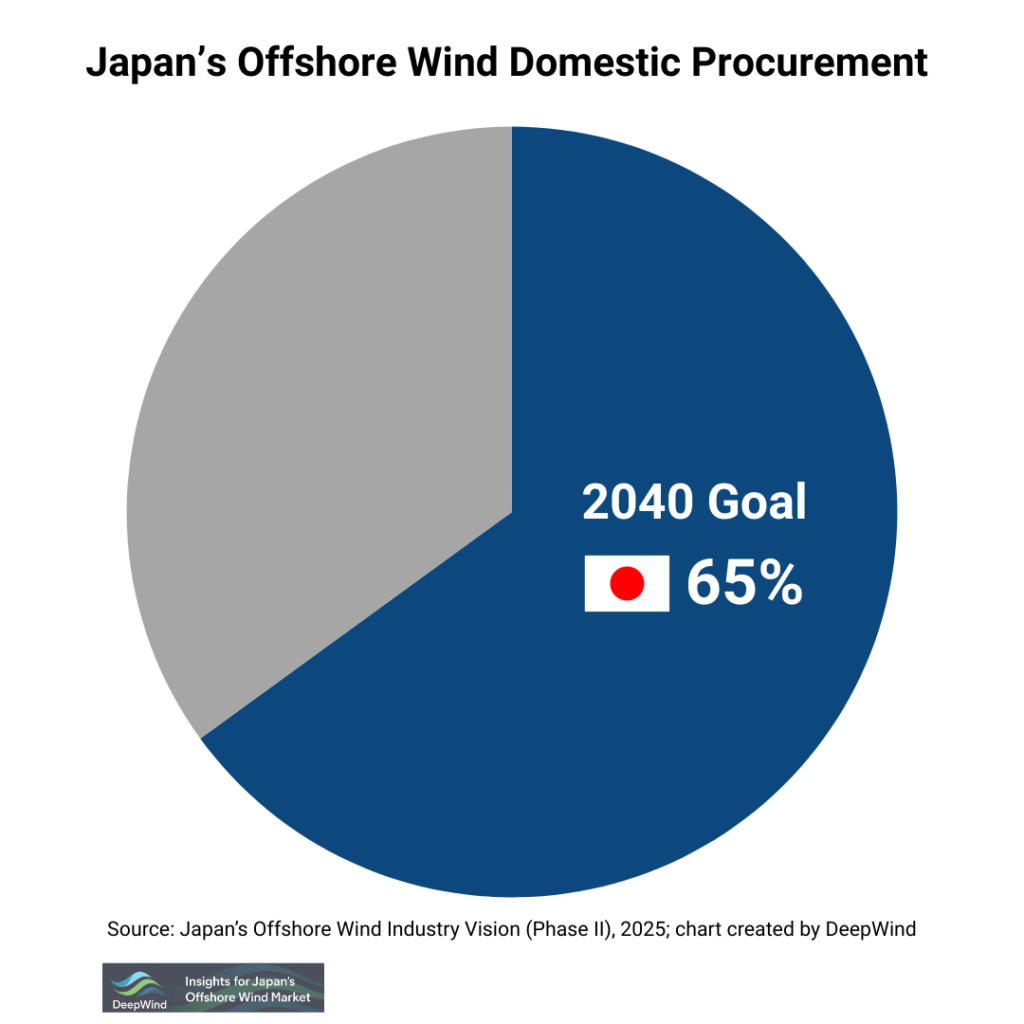

Furthermore, under the Second Offshore Wind Industry Vision (Industrial Strategy for Floating Offshore Wind, etc.) released on August 8, 2025, the government and industry set a goal to form more than 15 GW of floating offshore wind projects by 2024, while also aiming to raise the domestic procurement ratio to over 65% by 2040.

To achieve these targets, Japan will need to simultaneously advance both technical and institutional cost-reduction measures — including the development of domestic manufacturing bases for key turbine components, the enhancement of port and grid infrastructure, and government-led financial support programs.

Conclusion

Japan’s offshore wind power cost structure remains high today, driven by Capex, O&M, and transmission demands. Yet with ambitious policy targets, large-scale procurement, technology upscaling, and supply-chain development, Japan is poised to achieve dramatic cost reductions—potentially reaching global competitiveness by the mid-2030s. As the nation charts its path toward carbon neutrality, offshore wind will be a cornerstone of a decarbonized energy future.

If you’re interested in a deeper understanding of offshore wind costs—including both fixed-bottom and floating projects—don’t miss our in-depth overview article:

🌊 Cost Structure and Economics of Offshore Wind

Japan’s offshore wind is no longer constrained by ambition — but by viability.📘 DeepWind Premium Report

A decision-oriented report synthesizing commercial viability, cost/revenue misalignment, supply-chain constraints, and Round 4 implications.

View the report (Gumroad)

- 🔍Market Insights – Understand the latest trends and key topics in Japan’s offshore wind market

- 🏛️Policy & Regulations – Explore Japan’s legal frameworks, auction systems, and designated promotion zones.

- 🌊Projects – Get an overview of offshore wind projects across Japan’s coastal regions.

- 🛠️Technology & Innovation – Discover the latest technologies and innovations shaping Japan’s offshore wind sector.

- 💡Cost Analysis – Dive into Japan-specific LCOE insights and offshore wind cost structures.