Japan is placing increasing emphasis on the Long-Term Decarbonization Power Supply Auction (LTDA) as a central component of its energy policy. Developing decarbonized power sources requires massive capital investment—often hundreds of billions of yen—yet power market prices in Japan remain highly volatile. Under such conditions, traditional FIT and FIP schemes no longer provide sufficient revenue certainty for large-scale, capital-intensive renewable projects.

To address this challenge, the government introduced the LTDA as a new mechanism designed to guarantee recovery of fixed costs (CAPEX + fixed OPEX) over a 20-year period.

This article provides a comprehensive and up-to-date explanation based on the latest public documents, covering:

- How the mechanism works

- Eligible power sources

- Application to offshore wind Round 2 and Round 3

- Impacts on developers and electricity consumers

- Relationship with corporate PPAs

- Case study using DeepWind’s cost model

While this article focuses on a specific topic, those looking to understand Japan’s overall offshore wind policy and regulatory framework should also read our comprehensive summary here:

👉 Japan’s Offshore Wind Policy & Regulatory Framework Explained

1. What Is the LTDA? — A “Fixed-Cost Recovery” Scheme Built Around Capacity Payments

The LTDA is designed to simultaneously support decarbonization of Japan’s power mix and investment certainty for long-term, capital-intensive projects.

The key feature of the scheme is that revenue is paid based on installed capacity (kW), not energy output (kWh).

Successful bidders receive an annual capacity revenue (JPY/kW/year) for 20 years, enabling them to recover their construction costs and fixed O&M expenses.

Government documents describe the LTDA as:

“A mechanism that guarantees a level of capacity revenue equivalent to fixed costs.”

Because capacity revenue is stable and long-term, the scheme significantly improves bankability, enabling easier access to financing—something FIT and FIP could not fully provide for large-scale projects.

2. How LTDA Differs from FIT and FIP

FIT and FIP reward generators based on energy output (kWh).

In contrast, the LTDA pays for capacity (kW) regardless of actual generation.

Comparison of Revenue Mechanisms

| Scheme | Revenue Basis | Market Exposure | Primary Objective |

|---|---|---|---|

| FIT | kWh | None | Accelerate early renewable deployment |

| FIP | kWh + premium | Partial | Integrate renewables into the market |

| LTDA | kW (capacity value) | Yes — market revenue varies, but upside and downside are largely neutralized under the LTDA. | Stabilize long-term investment in decarbonized power |

Because LTDA guarantees fixed-cost recovery, investment risk is dramatically reduced—although upside from high market prices becomes limited (explained later).

3. Around 90% of Market Revenue Must Be Returned — “Capping Upside to Guarantee Fixed Cost Recovery”

One of the most important design features is the revenue return mechanism:

Approximately 90% of market-derived revenue must be returned to the government.

Applicable revenue sources include:

- JEPX spot market income

- ΔkW balancing market income

- Non-fossil value certificate revenue

- PPA revenue equivalent to market prices

Only around 10% of market revenue remains with the generator.

In exchange, the LTDA guarantees a stable stream of capacity revenue sufficient to recover fixed costs.

4. LTDA Application to Offshore Wind — Only Allowed for “Round 2 and Round 3”

Latest official documents clarify the treatment of offshore wind:

- Round 1: Not eligible

- Round 2 & Round 3: Eligible as a temporary, exceptional measure

- Round 4 onward: LTDA participation is not envisioned

This separation avoids strategic distortions between the offshore wind “Round system” and the LTDA, while providing transitional support for projects exposed to global cost inflation and higher interest rates.

In effect, LTDA functions as a stabilization mechanism to ensure Round 2 and 3 projects can reach completion.

5. Price Caps — Offshore Wind Up to JPY 180,655–200,000/kW/year

The latest METI documentation sets upper price limits for each power source.

For offshore wind:

Price cap: 180,655–200,000 JPY/kW/year

This is a regulatory ceiling, not the expected bid price.

DeepWind’s analysis shows that offshore wind’s required capacity price is closer to 100,000–120,000 JPY/kW/year—far below the cap.

6. Capacity Factor Requirements Are Being Formalized

Latest documents explicitly state:

“Generators must achieve annual capacity factors appropriate for each power source.”

For offshore wind, specific thresholds are still under discussion.

Since capacity factors depend on weather, this requirement introduces a new compliance risk for developers.

7. Case Study: Murakami–Tainai Offshore Wind — LTDA Profitability

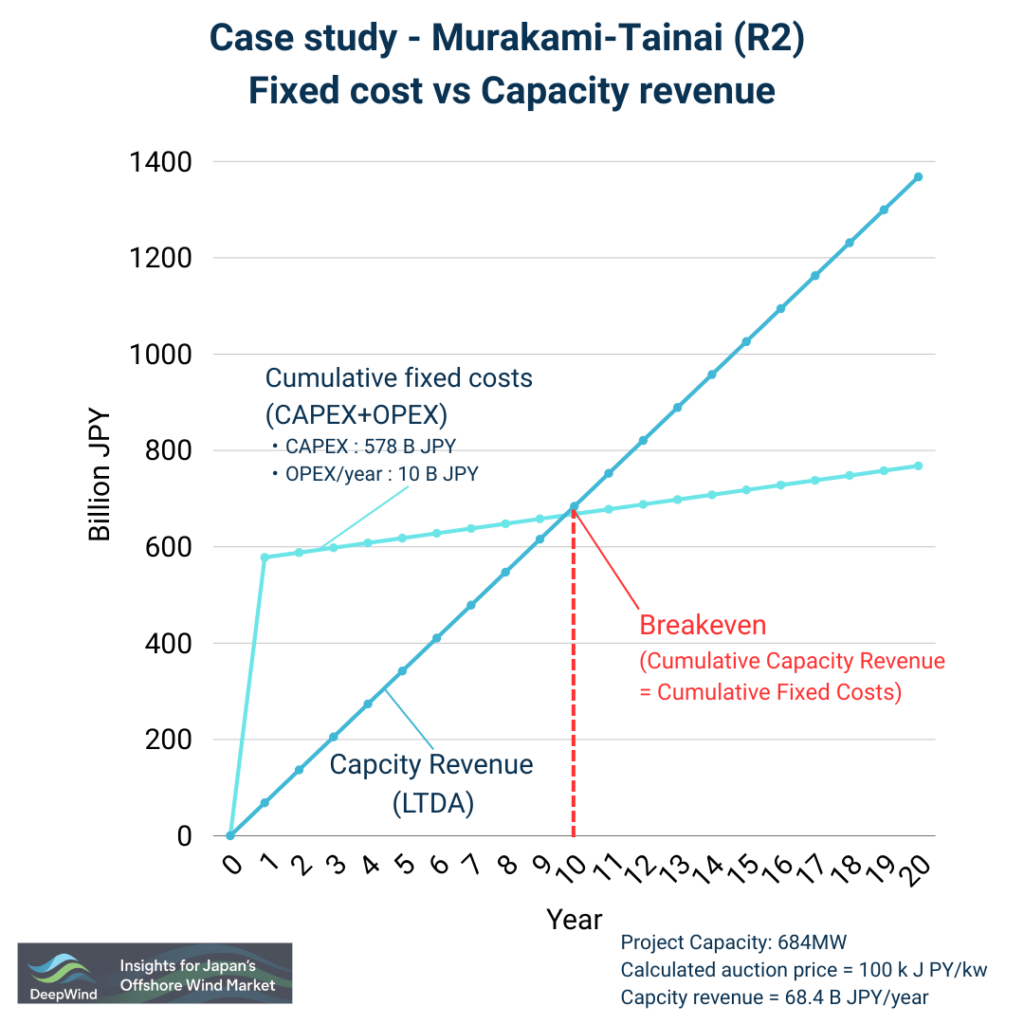

① Cost Estimation Based on the Previous Cost Model

- CAPEX: JPY 578 billion

- OPEX: JPY 10 billion/year

- Capacity: 684 MW

- Operational lifetime: 25 years

Scenario: Winning bid at 100,000 JPY/kW/year

- Capacity revenue: JPY 68.4 billion/year

- Market revenue: ~90% returned → negligible effect on profitability

The cumulative capacity revenue surpasses cumulative fixed costs around year 10, meaning LTDA provides substantial revenue stability compared with merchant exposure.

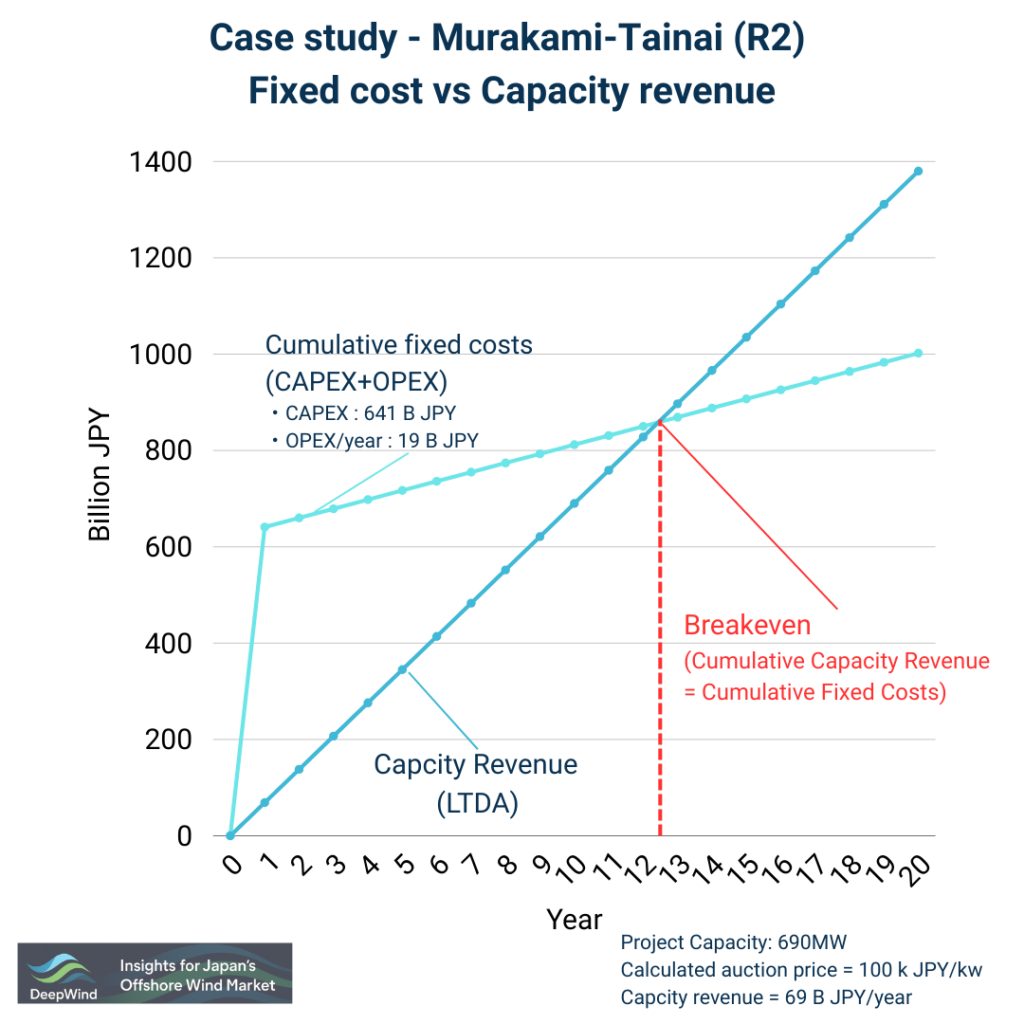

② Cost Estimation Based on the Latest Cost Model (Added on January 26, 2026)

Mitsui & Co. and Osaka Gas announced on January 20, 2026, that they are considering a revision to their offshore wind power project planned off the coast of Murakami City and Tainai City in Niigata Prefecture.

The project had originally aimed to adopt 18 MW turbines—the largest output class globally—but plans are being revised to use 46 units of 15 MW turbines after GE Vernova decided to halt production.

Turbine configuration:

Assuming a configuration of 15 MW × 46 turbines, cost estimates were conducted based on DeepWind’s latest cost model (as of January 2026).

Estimated results:

- CAPEX: approximately JPY 640 billion (estimated)

- OPEX: approximately JPY 19 billion per year (estimated)

- Installed capacity: 690 MW

- Operating period: 30 years (assumed)

Scenario: Winning bid at 100,000 JPY/kW/year

- Awarded price: JPY 100,000/kW/year (estimated)

- Capacity revenue: approximately JPY 69 billion per year

- Market revenue: 90% returned to the system → only 10% retained, therefore not considered in the calculation

The case study results indicate that, assuming an awarded price of JPY 100,000 per kW per year in the Long-Term Decarbonized Power Source Auction, the project reaches its break-even point in approximately 13 years.

If capacity payments are made over a 20-year period, the results show that the project comfortably exceeds the profitability threshold.

8. Developer Benefits and Drawbacks

Benefits

- Capacity revenue greatly increases fixed-cost recovery certainty

- Enhanced bankability, enabling smoother financing

- Almost immune to market price spikes or volatility

- Provides critical stabilization for Round 2–3 offshore wind projects

Drawbacks

- Around 90% of upside market revenue is returned

- Risk of penalties for unmet capacity factor requirements

- Limited room for PPA-based revenue optimization

9. Benefits and Drawbacks for Offtakers

Benefits

- Generators have already recovered fixed costs via capacity revenue → very low default risk

- Enhances stability for long-term corporate PPAs

Drawbacks

- Limited profit margin on the generator side → less flexible PPA terms

- Potentially weaker incentives for long-term performance upgrades

10. Relationship with Corporate PPAs — Is There a Conflict?

There is partial structural conflict.

Under LTDA, PPA revenue above market-equivalent pricing is treated as “other market revenue” and ~90% must be returned.

This means high-price PPAs do not significantly benefit the generator.

However, for offtakers:

- A generator with fixed-cost recovery guaranteed

- Presents very low supply risk

→ Making LTDA-supported projects attractive PPA partners despite the revenue constraints.

If you want to know comprehensivIe overview of PPAs and Corporate PPAs, including basic concepts, contract schemes, institutional frameworks in Japan, recent case studies, and key challenges and prospects for the future, check out this article.

👉 What Is a Corporate PPA? Japan Market Guide with Price, Structure & Case Studies

11. Conclusion — LTDA Is an “Investment Stabilizer” and a Safety Net for Offshore Wind Round 2/3

Key implications:

- LTDA dramatically reduces investment risk for decarbonized power

- Offshore wind is only eligible for Round 2–3 as a transitional measure

- The 200k price cap is a ceiling; practical needs are around 100k–120k

- Market upside is limited, but fixed-cost recovery is ensured

In short:

LTDA is a financial stabilization mechanism designed to ensure project completion—especially for offshore wind Round 2 and 3.

It functions as a policy safety net ensuring that capital-intensive decarbonization projects can move forward despite market volatility and rising global costs.

For a broader understanding of Japan’s offshore wind legal system, policy structure, and support measures, be sure to check out our pillar article:

🌊 Japan’s Offshore Wind Policy & Regulatory Framework Explained

📘 DeepWind Premium Report

Japan’s offshore wind is no longer constrained by ambition — but by viability.

A decision-oriented report synthesizing commercial viability, cost/revenue misalignment, supply-chain constraints, and Round 4 implications.

- Commercial viability (CAPEX/OPEX vs revenue)

- Supply-chain & execution constraints

- Round 4 / re-auction implications