Introduction

As Japan and many other nations accelerate their efforts to achieve carbon neutrality by 2050, the adoption of renewable energy is gaining significant momentum. Among the various mechanisms supporting this transition, one that has attracted particular attention is the Power Purchase Agreement (PPA).

In particular, Corporate PPAs, which allow businesses to directly and long-term procure renewable electricity from power producers, are expanding rapidly around the globe as a means to achieve decarbonized operations and meet ESG requirements.

PPAs serve as a critical tool for power producers by ensuring revenue stability and enabling project financing. For companies, PPAs offer a practical path to procure additional renewable energy and stabilize electricity costs over the long term.

This article provides a comprehensive overview of PPAs and Corporate PPAs, including basic concepts, contract schemes, institutional frameworks in Japan, recent case studies, and key challenges and prospects for the future.

For a structured overview of Japan’s offshore wind market—including policy, investment dynamics, costs, and supply-chain constraints—see our pillar article.

👉 Japan Offshore Wind Market Analysis (Pillar)

1. What is a PPA?

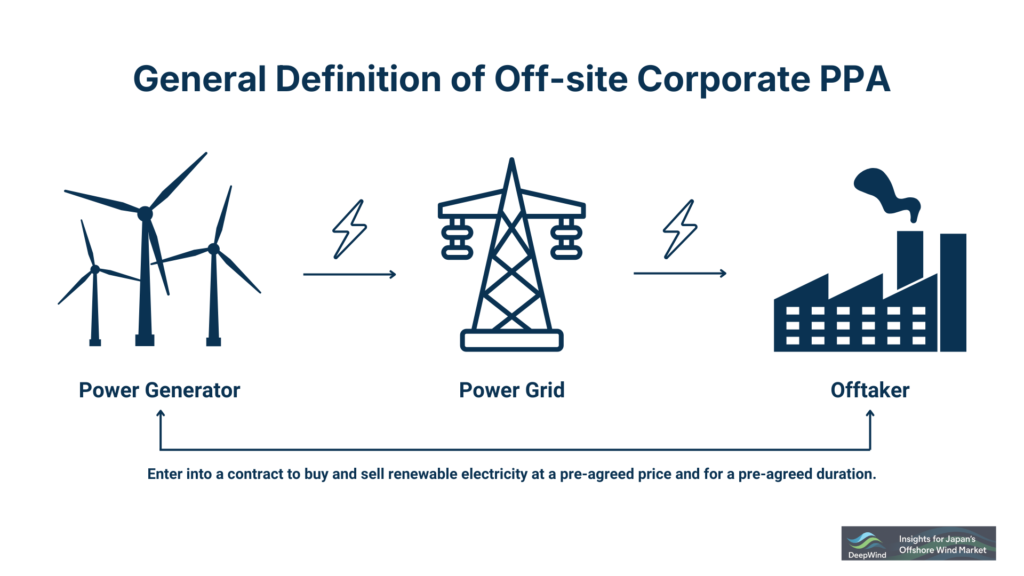

A Power Purchase Agreement (PPA) is a contract between a power generator and an electricity buyer, under which electricity is supplied and purchased over a fixed period—typically 10 to 20 years. The contract specifies key terms such as price, volume, and treatment of environmental value in advance.

For power producers, a PPA secures long-term revenue, facilitating bank financing (e.g., non-recourse loans) and investment decisions. For buyers, it enables predictable energy costs and shields them from market volatility.

1-1. Differences Between FIT and FIP

- FIT (Feed-in Tariff): A system in which power producers sell electricity at a fixed rate to utility companies, with price guarantees provided by the government. Direct contracts with corporations are not permitted.

- FIP (Feed-in Premium): Power producers sell electricity either on the market or through PPAs, and the government pays a premium to cover the price difference. Corporate PPAs are allowed.

If you want to learn more about fit and fip, check out this article.

👉 FIT and FIP Schemes in Japan Explained

2. What is a Corporate PPA?

Among PPAs, those in which the power purchaser is a corporation are referred to as Corporate PPAs. In this model, a renewable energy generator and a company (such as those in manufacturing, retail, or IT) enter into a long-term contract either directly or via a retail electricity provider.

2-1. Why companies are adopting PPAs

In recent years, companies are increasingly expected not only to consume electricity but also to take responsibility for the environmental value of its source. The role of corporate PPAs is rapidly expanding amid the growing adoption of international frameworks such as:

- RE100: A global initiative committing businesses to 100% renewable electricity.

If you want to learn more about RE100, check out this article.

👉 What Is RE100? – A Global Initiative Targeting 100% Renewable Electricity - CDP / SBTi / TCFD: Frameworks for disclosing climate action and emission reduction targets.

- Scope 2 reduction: Reducing indirect emissions from purchased electricity requires procurement with environmental attributes.

For a structured overview of Scope 2 and the location-based vs market-based methods, see our separate Scope 2 explainer article.

👉 What Is Scope 2? Definition, Examples, Calculation Methods, and the Market-Based vs Location-Based Approaches

2-2. Key Benefits of Corporate PPAs

| Purpose | Details |

|---|---|

| Direct procurement of renewables | Purchasing power directly from generators and acquiring non-fossil certificates. Supports RE100 compliance. |

| Ensuring additionality | Contracting with new power plants helps increase the amount of renewable energy introduced. |

| Cost stability | Protection from market price fluctuations with fixed pricing over 10+ years. |

| Corporate branding | Demonstrates commitment to decarbonization, improving reputation with investors and customers. |

Corporate PPAs are thus an essential tool for companies to align environmental value with economic rationality.

3. Main Types of Corporate PPA Schemes

Corporate PPAs come in several forms depending on the method of power supply and contractual structure. Companies should choose the most appropriate scheme based on their facility setup, power demand, and regulatory conditions. Below are four representative schemes currently adopted in Japan.

3-1. Onsite PPA (On-premise Installation Model)

This scheme involves installing renewable energy facilities (e.g., solar panels) on the rooftops or premises of corporate buildings or factories, allowing the company to consume the generated power directly.

- The equipment is owned and operated by the PPA provider, so the company does not need to invest in facilities.

- Since supply is completed onsite, the grid is not used—no transmission charges or renewable energy surcharges apply.

- Under Japanese law, this is not considered a “supply” of electricity, so registration as a retail electricity provider is not required.

- The company pays for the electricity based on the generated volume (e.g., per-kWh rate) during the contract period.

3-2. Offsite PPA (Remote Supply Model)

This model involves supplying electricity from a renewable energy facility located offsite via the transmission and distribution grid. As companies accelerate their decarbonization strategies, securing renewable electricity through Off-site Corporate PPAs has become an essential option—offering long-term price stability, reliable environmental value, and alignment with global standards such as RE100 and SBTi. Yet terms like Physical vs Virtual PPA, direct vs indirect models, or how self-wheeling differs from PPAs often create confusion for many decision-makers.

This article provides a clear, practical explanation of off-site PPAs in Japan, based on the official guidance published by the Ministry of the Environment. We break down the mechanism, cost structure, risks, and regulatory positioning of off-site PPAs, offering an easy-to-understand overview for both professionals and non-experts considering adoption in Japan.

👉 Off-site Corporate PPA in Japan: How It Works, Cost Structure, and Key Risks

3-3. Virtual PPA (vPPA)

In this scheme, no physical delivery of electricity occurs. Instead, it is a contract for difference between the market price and a fixed “strike price.”

- The generator sells electricity on the wholesale market (e.g., JEPX).

- The company continues to purchase electricity from their conventional provider.

- However, the agreement assumes a transaction at the fixed strike price.

- The environmental value (e.g., non-fossil certificates) is transferred to the company, allowing renewable electricity usage to be claimed.

Note: Hybrid Models Emerging

Recently, composite models have become more common, such as:

- Combined with FIP: A three-layered structure combining market sales, corporate contracts, and premium payments.

- Onsite PPA + vPPA: Using onsite generation during the day and vPPA for nighttime consumption.

- Aggregated PPAs: One contract covering multiple facility sites.

4. Corporate PPA Trends in Japan

In Japan, corporate PPAs began somewhat cautiously but have accelerated significantly in recent years. This is largely thanks to the introduction of the FIP (Feed-in Premium) scheme and the development of self-wheeling systems. The tightening of decarbonization requirements for companies is also driving demand.

4-1. FIP Scheme Promoting Direct Contracts

The FIP scheme, introduced in 2022, allows renewable energy generators to sell power via market sales or PPAs, receiving a premium on top of the market price.

- The FIP system expands opportunities for direct corporate contracts (corporate PPAs), as FIP generators can sell electricity directly.

- FIP-based projects can achieve reasonable returns even when contracted at market-linked prices.

- Unlike FIT, where revenue is fixed, the FIP structure naturally promotes the adoption of market-linked contracts.

As a result, FIP has become a major driver accelerating the practical adoption of corporate PPAs in Japan.

4-2. Legal Reform and Limitations of the Self-Wheeling System

Japan’s “self-wheeling system” allows a generator to send electricity to its own facilities via the grid, avoiding the renewable energy surcharge. This system is gaining attention as a tool for PPA implementation.

However, several limitations remain:

- Institutionalized in 2021, with a planned review in 2024.

- Available only to companies that are both the generator and the grid user (same corporate group, joint ownership, etc.).

- Transfer to third-party customers is not allowed under current regulations.

As such, self-wheeling is suitable mainly for startups or companies with multiple owned facilities, while the “sleeved PPA” via a retail electricity provider is generally more accessible.

4-3. Legal Development and Standardization of Virtual PPAs

Virtual PPAs (vPPAs) are contractual agreements in which companies pay the difference between market prices and a predetermined strike price, rather than receiving physical electricity. They are recognized internationally as a key tool for Scope 2 emissions reduction.

- In Japan, legal clarity is still developing, especially regarding how to define the transfer of environmental attributes and accounting for gains/losses.

- Tax, accounting, and corporate governance rules must also evolve to support vPPAs.

- Global companies such as Microsoft Japan and Google have been early adopters.

Currently, only a limited number of cases exist in Japan, but vPPAs are expected to grow rapidly as a viable model, especially for companies aiming for international ESG alignment.

4-4. Sleeved PPAs Gaining Popularity via Retail Providers

In Japan, offsite PPAs—particularly sleeved PPAs mediated by retail electricity providers (PPS)—are gaining traction.

- The retailer procures electricity from a specific renewable generator and supplies it to the company.

- This model simplifies legal and operational burdens for the buyer.

- Power balancing, grid usage, and non-fossil certificates are all managed by the retailer.

Major Japanese companies, including ENEOS and Marubeni, have begun offering PPA-based renewable supply services, and a growing number of corporate users are opting for this structure.

4-5. Practical Challenges and Institutional Barriers

In order to scale the adoption of PPAs, the following practical and operational challenges must be addressed:

| Challenge | Overview |

|---|---|

| Responsibility for Power Supply Balancing | Renewable energy is a variable source. A key issue is how to handle balancing responsibilities under PPA contracts (typically managed by retail electricity providers). |

| Rising Transmission and Capacity Charges | Future increases in grid usage costs are expected, which could undermine the price competitiveness of PPAs. |

| Complex Contract Negotiations | Long-term PPA contracts require specialized knowledge in legal, financial, and technical areas—creating hurdles especially for small and medium-sized enterprises (SMEs). |

| Tight Supply and Price Volatility of Non-Fossil Certificates | With a decline in certificates from FIT-backed sources, prices are trending upward. Cost comparison with vPPA and offsite PPAs becomes increasingly important. |

In the next section, we will introduce advanced case studies of corporate PPAs implemented both in Japan and internationally using the above schemes.

5. Case Studies: Japan and Global Examples

PPAs are gaining popularity as a key tool for companies pursuing carbon neutrality and RE100 goals. This section highlights notable implementations in Japan and abroad, showcasing diverse approaches and business models.

5.1. Notable Domestic Cases in Japan

Murata Manufacturing × RENOVA: vPPA (115 MW)

- Overview: Signed a virtual PPA with RENOVA for 115 MW of new solar power generation capacity (2022 agreement, 2023 start).

- Features:

- Aims to decarbonize global operations via vPPA structure.

- Employs a strike price contract structure to hedge against electricity price fluctuations.

- One of Japan’s largest virtual PPAs to date.

Microsoft Japan × Nature Group: vPPA (25 MW)

- Overview: Signed a vPPA in 2022 to procure 25 MW of solar-generated electricity.

- Purpose: Targeting 100% renewable energy in Japan, supporting Scope 2 reduction.

- Features: Demonstrates global tech firms’ push toward local PPA adoption.

JR East × Sumitomo Corporation: Offsite Wind PPA (FIP-backed)

- Overview: JR East plans to procure 20 MW of wind power from a new Hokkaido project developed by Sumitomo.

- Features:

- First major case applying the new FIP scheme in a corporate offsite PPA.

- Joint release from the generator, retailer, and corporate buyer.

AEON Mall: Nationwide Rollout of Onsite PPA

- Overview: Deploying solar power systems across its malls using the onsite PPA model.

- Features:

- Accelerates decarbonization of facility operations.

- Retailer provides capital investment, allowing AEON to access renewable power with no upfront costs.

5.2. Notable International Cases

Amazon (U.S., EU, Asia)

- Goal: Decarbonize operations such as logistics and data centers; RE100 target.

- Scale: One of the largest corporate PPA buyers globally, with 500+ projects totaling over 20 GW (as of 2023).

- Model: Combines vPPA and offsite PPA; large-scale contracts with wind/solar developers.

Google (Global)

- Goal: Achieve “24/7 carbon-free electricity” by matching every hour of usage with clean energy.

- Features:

- Bundled renewable energy and non-fossil certificates.

- Simultaneously signs long-term contracts and local procurement.

LyondellBasell (Chemicals)

- Goal: Decarbonize European operations through multiple PPA contracts.

- Features:

- Signs long-term PPAs as a strategic hedge against energy cost volatility.

Walmart, IKEA, and Other Retail Giants

- Model: Actively utilize onsite PPA and aggregated virtual PPA (pooling demand across facilities).

- Features:

- PPA mechanisms increasingly serve as a tool for managing ESG and brand value in retail sectors.

5.3. Key Differences Between Japan and Overseas Markets

| Category | Japan | Europe/US |

|---|---|---|

| Typical Models | Sleeved PPA, vPPA (limited), self-wheeling | vPPA or direct bilateral PPAs are common |

| Legal & Regulatory | Limited liberalization; complex coordination required | Comparatively liberal (especially in deregulated markets) |

| Environmental Tracking | Non-fossil certificates (mainly FIT-based) | REC, GoO (Guarantee of Origin) widely available |

| Market Stage | Expansion Phase (post-FIP acceleration) | Mature Market (PPA marketplace exists) |

6. Corporate PPA Price, Trends & Future Outlook

6-0. Corporate PPA Price in Japan: Summary

Typical corporate PPA price stack = Energy (market or fixed) + Environmental certificates + Grid & balancing + Retail margin.

Corporate PPAs are expected to become a key driver for corporate-led renewable energy adoption and decarbonization efforts. Especially in Japan, the introduction of FIP and growing awareness of ESG/RE100 goals are driving a rapid expansion of PPA models.

The following six trends are expected to shape the future landscape of corporate PPAs in Japan:

6-1. Establishment of PPAs as a Main Post-FIT Procurement Mechanism

- As FIT declines, PPAs are becoming the default method of renewable procurement for companies.

- To achieve carbon neutrality and decarbonization goals, corporations must invest in renewable energy procurement.

- Policy support is shifting from price-guaranteed FIT schemes to market-linked FIP and PPAs.

- The combination of FIP and corporate PPAs will create a foundation for sustainable and market-driven investment in renewables.

6-2. Diversification and Hybridization of Schemes

- Models such as vPPA, onsite PPA, offsite PPA, and hybrid forms are emerging to suit diverse corporate needs.

- Large corporations are experimenting with hybrid PPA structures that combine multiple procurement models.

- Meanwhile, small and medium enterprises (SMEs) are more likely to adopt simplified or aggregated PPA models supported by intermediaries.

6-3. Economic Rationality and Cost Competitiveness

- As the cost of renewables decreases and FIP incentives take hold, PPAs are increasingly cost-competitive with traditional procurement.

- The rising cost of fossil fuels and environmental levies is also pushing companies toward PPA-based sourcing.

- Non-fossil certificate prices are rising due to supply constraints, further emphasizing the value of long-term PPAs.

6-4. Integration with Offshore Wind and Battery Storage

- In the future, PPAs may expand into offshore wind and battery storage markets.

- As offshore wind scales up, developers are preparing PPA models aligned with FIP, targeting large-scale corporate procurement.

- Battery-linked PPAs are emerging in global markets to support 24/7 renewable power supply (e.g., Google, Microsoft).

6-5. Growth of Marketplaces and Matching Platforms

- In Europe and the U.S., PPA marketplaces and matching platforms (e.g., LevelTen Energy) are already well developed.

- Japan is expected to see similar platforms emerge, offering streamlined access to sellers, buyers, and intermediaries.

- Marketplaces will facilitate contract standardization and price transparency in corporate PPA deals.

6-6. Continuous Policy and Regulatory Updates

- Legal clarity around balancing responsibility, grid access, and non-fossil certificates is crucial.

- As the role of PPAs expands, the regulatory framework must evolve to support scalability and transparency.

- Discussion is underway around PPA tax incentives, new certificate issuance rules, and dedicated support mechanisms.

6-7. Key Takeaways and Future Directions

| Category | Future Outlook |

|---|---|

| FIP + PPAs | Market-linked mechanisms to become mainstream post-FIT |

| Legal Reform | Clarifying roles and contracts, standardizing regulations |

| vPPA/Offsite | Large-scale growth expected, especially among big corporates |

| SMEs | Growing adoption via simplified and aggregated schemes |

| Digital Tools | Growth of platforms for matching and deal tracking |

| Environmental Certs | Stronger linkage with carbon credit and policy reform |

What is a PPA?

A Power Purchase Agreement (PPA) is a long-term contract between a power generator and an electricity buyer, specifying terms such as price and volume. It provides stable revenue for producers and predictable costs for buyers.

What is a Corporate PPA?

A Corporate PPA is a type of power purchase agreement where the buyer is a corporation, such as a manufacturer or retailer. It allows companies to directly procure renewable energy through long-term contracts with developers.

Why are companies directly procuring renewable energy?

Many companies are securing renewable energy to reduce carbon emissions, manage energy costs, and demonstrate environmental responsibility. Corporate PPAs help achieve sustainability targets while ensuring long-term electricity price stability.

What is a Non-Fossil Certificate (NFC)?

It is a system that extracts the “non-fossil value” of electricity generated from non-fossil power sources (methods of generating electricity without using fossil fuels such as oil or coal) and issues it as certificates for trading.

Source: METI

Summary

Corporate PPAs are rapidly emerging as a mainstream method of renewable energy procurement, particularly as the FIT program winds down. Backed by Japan’s FIP scheme and the rise of ESG-driven demand, PPAs are becoming a strategic tool for energy procurement.

As frameworks improve and awareness grows, PPAs are expected to evolve into a core mechanism for achieving corporate decarbonization. Companies aligned with RE100, SBTi, and other targets will increasingly turn to PPAs as part of their sustainability roadmap, shifting from FIT-based support to market-based and investor-backed mechanisms.

Japan’s offshore wind market cannot be understood through a single lens. A cross-cutting view—integrating policy, investment behavior, cost structures, and execution capability—is consolidated in our pillar article.

👉 Japan Offshore Wind Market Analysis (Pillar)

Round 4 Is Not a Reset.📘 DeepWind Premium Report

A concise, decision-oriented structural brief on what actually changed —

and what remains structurally broken.

- 🔍Market Insights – Understand the latest trends and key topics in Japan’s offshore wind market

- 🏛️Policy & Regulations – Explore Japan’s legal frameworks, auction systems, and designated promotion zones.

- 🌊Projects – Get an overview of offshore wind projects across Japan’s coastal regions.

- 🛠️Technology & Innovation – Discover the latest technologies and innovations shaping Japan’s offshore wind sector.

- 💡Cost Analysis – Dive into Japan-specific LCOE insights and offshore wind cost structures.