Introduction

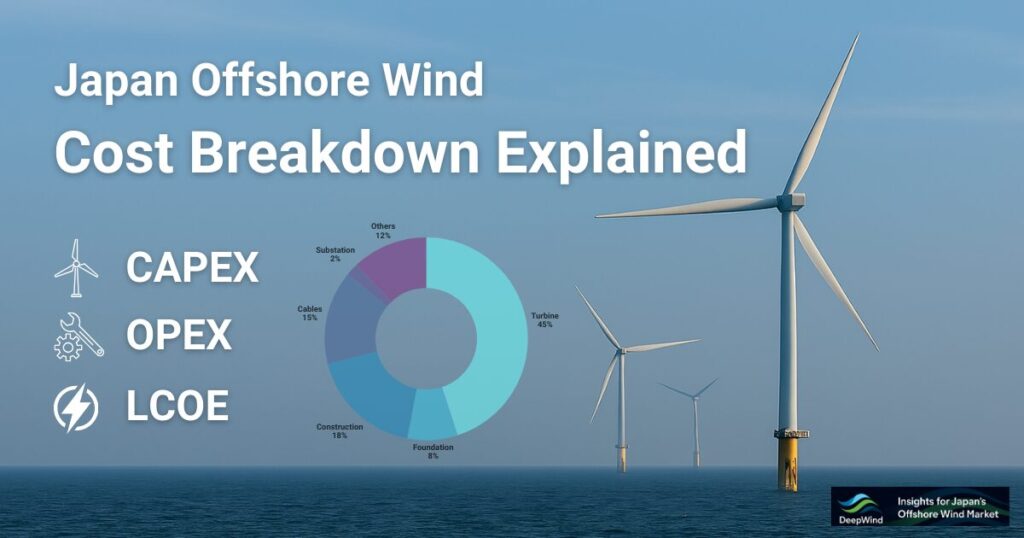

Evaluating the profitability of offshore wind projects requires close attention to cost-related indicators such as CAPEX, OPEX, LCOE, and IRR.

However, in Japan’s designated Promotion Zones, publicly available cost data remain scarce, leaving investors and developers with limited information for decision-making.

In this article, we assess the Oga Katagami Akita Offshore Wind, estimating CAPEX, OPEX, LCOE, and IRR using on DeepWind’s proprietary cost model which references the NEDO cost model and international benchmarks, based on representative site conditions including distance to shore, water depth, and distance to port.

While these figures are independent estimates, they provide useful insights into the characteristics of this zone and a basis for relative comparison with other areas.

This article focuses not on project progress or policy background, but on the cost analysis. If you would like to learn more about the project overview of the Oga Katagami Akita Offshore Wind Project, please see the article below.

👉 Oga Katagami Akita Offshore Wind Power Project

| Revision History |

| Nov. 2025: Updated CAPEX&OPEX model and LCOE&IRR recalculation. |

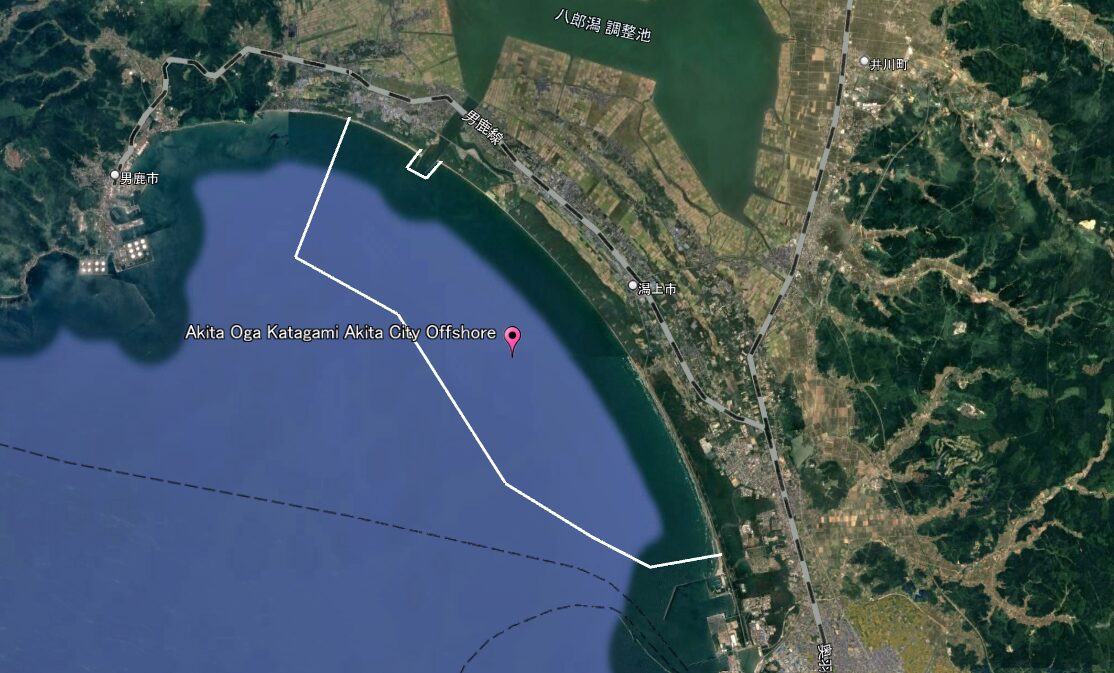

1. Area Overview

- Area Name: Oga Katagami Akita Offshore

- Location: West Offshore, Akita

- Estimated Capacity: 315 MW

- Status: Promotion Zone

- Developer: JERA, J-POWER, Tohoku Electric Power, ITOCHU Corp

2. Assumptions (Representative Values)

In this article, the representative point was set at the center of the designated promotion area polygon based on its coordinates. Water depth and distance conditions were estimated using data from NeoWins.

| Item | Estimated Value | Notes |

|---|---|---|

| Water Depth (m) | 12 m | Depth at representative point |

| Distance to Shore (km) | 2 km | Shortest distance to landfall point |

| Distance to Port (km) | 9.7 km | Straight-line distance to assumed O&M port |

3. CAPEX / OPEX Estimates

CAPEX and OPEX were independently estimated by DeepWind with reference to JWPA’s developer survey results and international benchmarks.

| Foundation type | Estimated CAPEX | Estimated OPEX |

|---|---|---|

| Monopile | Approx. JPY 256 B | Approx. JPY 4.3 B per year |

4. LCOE Estimate

The LCOE was independently estimated by DeepWind with reference to NEDO’s Offshore Wind Cost Model and NeoWins data.

| Foundation type | Gross CF | WACC | Estimated LCOE |

|---|---|---|---|

| Monopile | 35% | 3% | 24.1 JPY/kWh |

5. IRR Estimate

| Price conditions | Estimated IRR | Power Selling Price | Assumed Operating Period |

|---|---|---|---|

| Bid Price | – | 3 JPY/kWh | 25 years |

| Modeled Price (using market transactions or PPAs) | 3.4 % | 25 JPY/kWh | 25 years |

6. Profitability Rating (DeepWind Independent Evaluation)

| Evaluation Metric | Score (★1–5) | Result |

|---|---|---|

| Profitability (Modeled Price) | ★★ | Challenging |

| Overall Rating | C Rank | Low investment appeal; subsidies or regulatory support assumed. |

Conclusion

The Oga Katagami Akita Offshore Wind project shows moderate profitability with an estimated LCOE of around 24 JPY/kWh and an IRR of 3-4% under modeled price conditions. While this places the project in C Rank (Challenging) category, the outlook could improve with further cost reductions and supportive policy measures.

DeepWind will continue to deliver independent cost assessments of Japan’s offshore wind promotion zones, helping investors and developers benchmark opportunities and better understand the market’s evolving economics.

If you would like to compare the CAPEX, OPEX, LCOE, and IRR of other Promotion Zones, please also check out this summary article.

🌊 Cost Analysis of Japan’s 12 Offshore Wind Promotion Zones

Japan’s offshore wind is no longer constrained by ambition — but by viability.📘 DeepWind Premium Report

A decision-oriented report synthesizing commercial viability, cost/revenue misalignment, supply-chain constraints, and Round 4 implications.

View the report (Gumroad)

- 🔍Market Insights – Understand the latest trends and key topics in Japan’s offshore wind market

- 🏛️Policy & Regulations – Explore Japan’s legal frameworks, auction systems, and designated promotion zones.

- 🌊Projects – Get an overview of offshore wind projects across Japan’s coastal regions.

- 🛠️Technology & Innovation – Discover the latest technologies and innovations shaping Japan’s offshore wind sector.

- 💡Cost Analysis – Dive into Japan-specific LCOE insights and offshore wind cost structures.