As the global energy landscape shifts toward decarbonization, Japan stands at a pivotal moment in developing offshore wind power as a central pillar of its renewable energy strategy. The Japan Wind Power Association (JWPA) has laid out a comprehensive plan “Building the Industrial Base for Offshore Wind Power and Reducing Generation Costs” to address the current challenges and propose a roadmap for the industry’s evolution from its nascent stage to maturity by 2050. This article explores the core initiatives and envisioned outcomes presented in the JWPA’s November 2025 report.

1. A Nascent Sector Facing Economic Pressures

Offshore wind in Japan, while promising, remains in its early stages. Recent global economic changes, such as inflation and rising interest rates, have heightened project costs. These financial pressures have already led to the withdrawal of operators from several first-round sea areas. Without stable, long-term prospects, further investments could be postponed or cancelled, undermining both current and future developments.

To stabilize the industry, JWPA emphasizes the need for a secure and attractive business environment for upcoming project rounds. The association asserts that stable project formation and execution will enable the broader industrial ecosystem to flourish, ultimately reducing generation costs through economies of scale and technical advancements.

2. Vision for Industrial Infrastructure Development

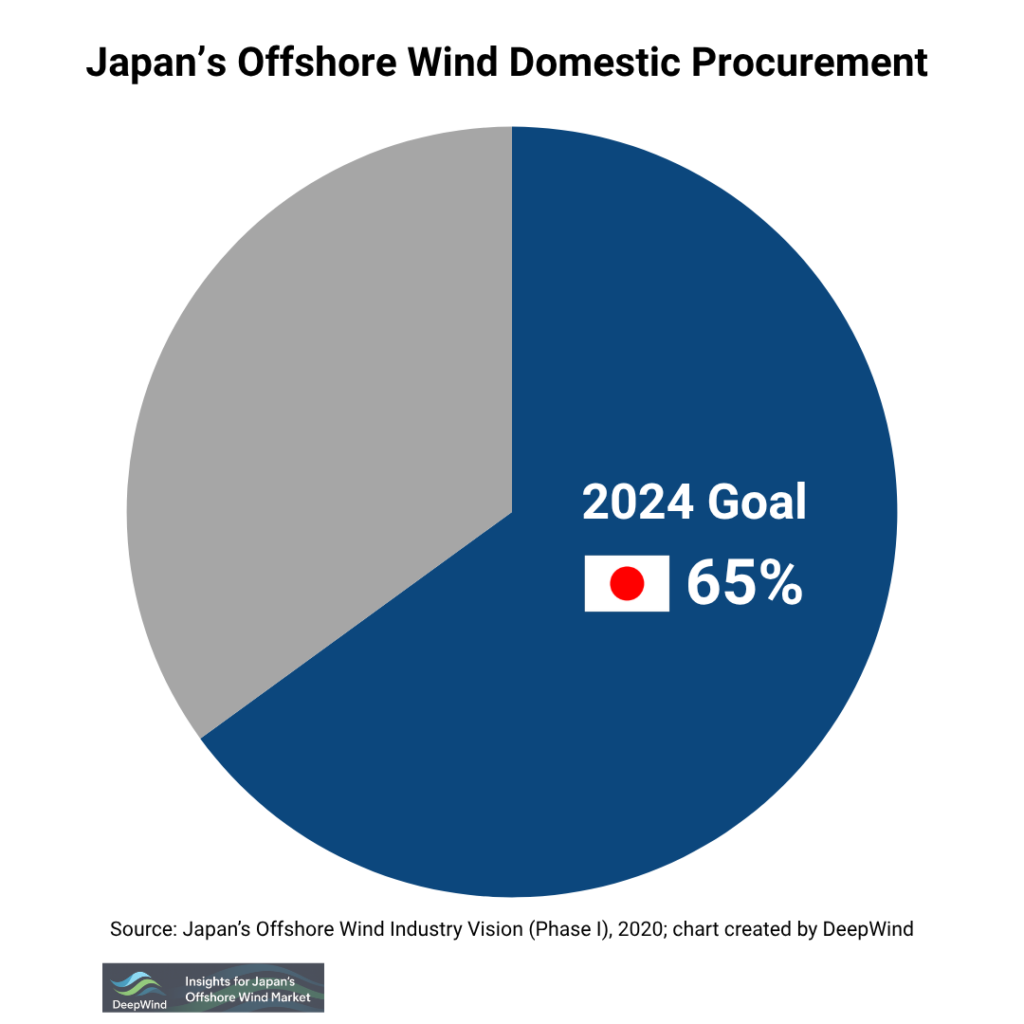

JWPA’s “Offshore Wind Industry Vision (Second Edition)” outlines a goal of achieving 65% domestic procurement and developing a skilled workforce of 40,000 by 2040. This ambition is underpinned by three strategic pillars:

1. Supply Chain Development

- Localization of manufacturing for nacelles, blades, foundations, and cables.

- Enhancing domestic production capabilities and securing construction vessels like SEP ships and cable-laying ships.

- Strengthening Japan’s role in the Asia-Pacific supply chain.

2. Technology Advancement

- Larger turbine blades to increase capacity factors.

- Optimized turbine placement to reduce wake effects.

- Implementation of drones and AI for efficient inspections and improved uptime.

- Standardization and streamlining of manufacturing and installation methods.

3. Human Resource Development

- Collaboration with ECOWIND and technical colleges.

- Establishment of training centers and regional partnerships.

- Development of specialized education programs and certifications.

These investments are expected to strengthen export competitiveness and support the scaling of floating wind infrastructure.

3. Creating a Virtuous Cycle in Industry and Investment

A key concept in JWPA’s strategy is creating a “virtuous cycle”: developing attractive markets and projects to encourage investment, which in turn facilitates supply chain strengthening and cost reduction.

Attractive Market Formation

- Strategic site investigations to plan 2-3GW/year of fixed-bottom projects from the mid-2030s.

- Policy reforms such as extending sea-use periods and improving public bidding systems.

- Infrastructure expansion, including port and grid enhancements aligned with project timelines.

Cost Reduction Through Industrial Foundation

The envisioned industrial base supports the integration of advanced manufacturing, optimized logistics, and a skilled workforce, contributing directly to reduced capital expenditures (CAPEX) and operating expenditures (OPEX).

4. Roadmap to Cost Reduction

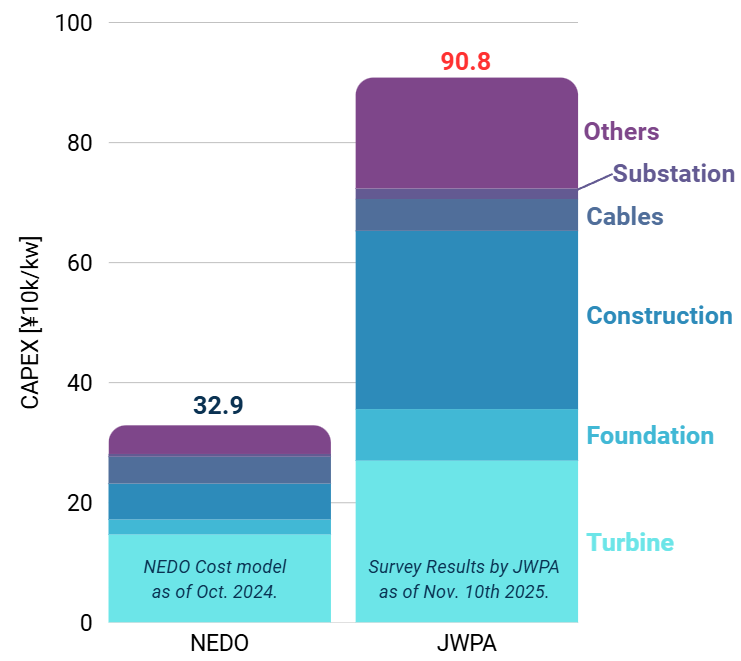

The report presents a detailed analysis of the current and projected costs:

Current Cost Structure

- CAPEX for monopile projects: ¥900,000/kW.

- OPEX: ¥12,300/kW/year.

- Resulting in a generation cost of approximately ¥22.4/kWh.

Survey Results by JWPA as of Nov. 10th 2025

2045 Cost Projection

- Equipment utilization rate improved from 36.6% to 41%.

- CAPEX reduced to ¥600,000/kW and OPEX to ¥8,000/kW/year.

- Target generation cost: ¥13.4/kWh.

These targets assume the successful formation of 30GW of fixed-bottom projects by 2040, facilitating learning effects and scale-driven efficiencies.

5. Learning Effects and Innovation Drivers

Cost reduction relies heavily on technological innovation and scaling. JWPA identifies three learning levers:

A) Mass Production

- Economies of scale in turbine, foundation, and cable production.

- Reduced transport and currency risk through domestic manufacturing.

B) Experience-Driven Efficiency

- Improved project execution through accumulated operational knowledge.

- Enhanced risk management and shorter construction periods.

C) Technology Development

- Use of advanced cranes and vessels to improve logistics.

- Adoption of remote monitoring and predictive maintenance.

- Development of more durable and lightweight materials.

These factors collectively yield a projected 34% reduction in CAPEX/OPEX by 2045.

6. Further Cost Reduction Strategies

Looking beyond 2045, JWPA identifies additional pathways:

- Supply Chain Maturity: Enabling exports, insurance premium reductions, and benefits from larger-scale projects.

- Breakthrough Technologies: Innovations like 25MW+ turbines, advanced fault detection systems, and high-voltage subsea cables.

- Enhanced Human Capital: Deepening industry-academia-government collaborations for high-skill workforce development.

European Benchmarking

The report draws on European offshore wind data to benchmark Japan’s path. Between 2014 and 2024, countries like the UK, Germany, and the Netherlands achieved a 50-60% cost reduction primarily through larger turbines and matured supply chains. While Japan’s trajectory may be more gradual, it is seen as feasible and replicable.

Summary

The JWPA’s roadmap is a call to action for both policymakers and industry leaders. Through deliberate market creation, strategic infrastructure investment, and sustained innovation, Japan aims to transform offshore wind into a reliable, cost-competitive power source.

By 2045, the nation could reach generation cost levels that support unsubsidized investment, making offshore wind a cornerstone in the country’s carbon-neutral ambitions. However, the path requires continued vigilance, collaboration, and adaptation to ensure goals are met and further cost reductions remain within reach.