This article is based on the Ministry of the Environment’s 2022 guidance on “Off-site Corporate PPA” and provides a clear explanation of how off-site PPAs work, how their pricing is structured, the risks involved, and how they can be implemented in Japan. DeepWind’s additional insights are included to make the content accessible even to non-experts.

(The official source is listed at the end of this article.)

If you want to learn more about PPAs and the increasingly popular corporate PPAs, check out this article.

👉 What Is a Corporate PPA? Japan Market Guide with Price, Structure & Case Studies

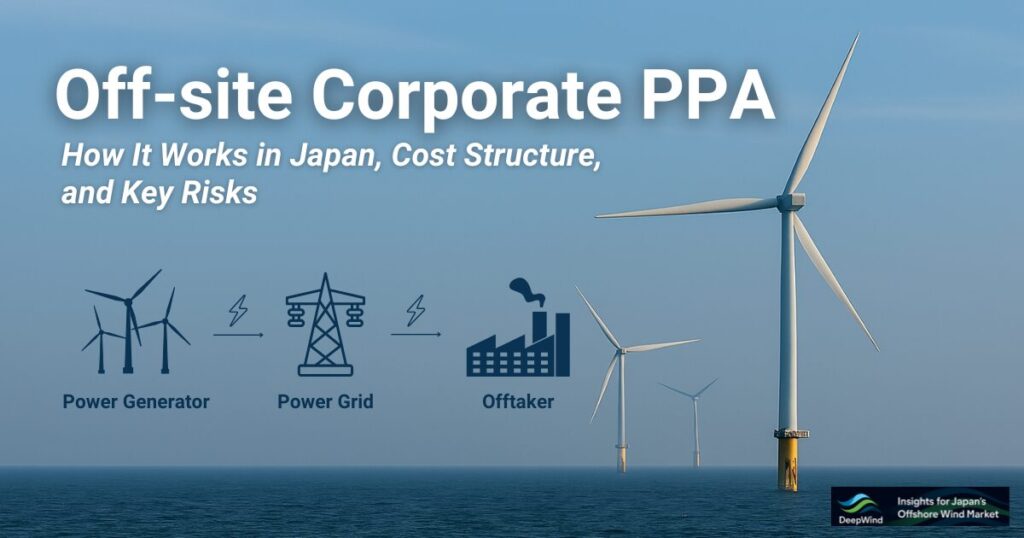

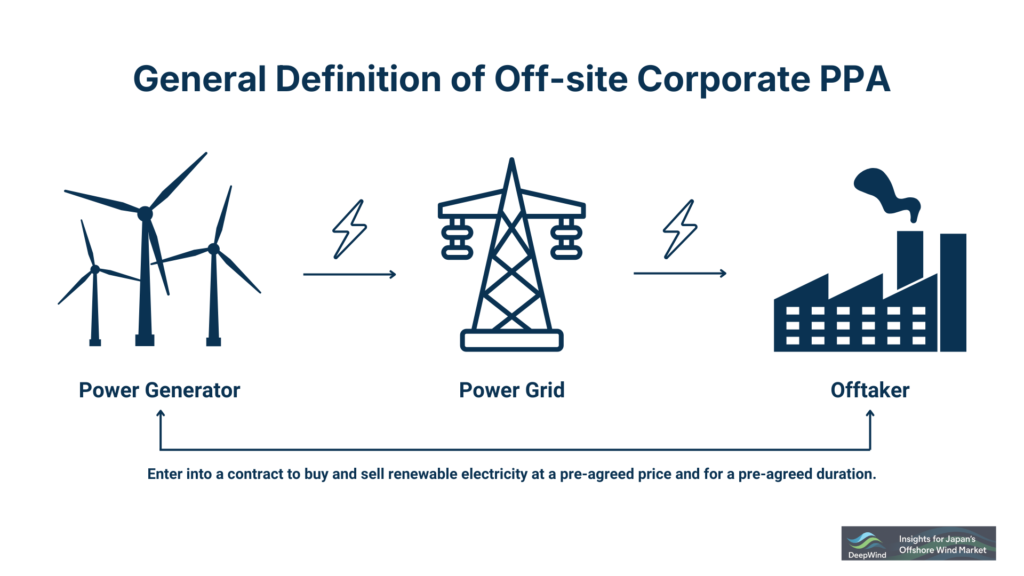

1. What Is an Off-site PPA?

Off-site Corporate PPAs are long-term contracts in which companies procure renewable electricity generated outside their premises at a pre-agreed price and duration.

As the name suggests, the power plant is not located on the company’s property. Instead, electricity generated at a remote site is delivered through the power grid. This enables companies to access large-scale renewable energy even without available land.

Why is it attracting attention?

- Protection against price volatility through long-term fixed pricing

- Guaranteed access to renewable “environmental value” (non-fossil certificates)

- Aligns with global sustainability requirements like RE100, SBTi, and TCFD

These factors are driving adoption among Japanese companies.

2. Difference from On-site PPA

On-site PPAs involve installing solar panels or other renewable assets directly on company premises. Off-site PPAs, on the other hand, source electricity from remote locations. This creates differences in the available project scale and cost structure.

Comparison: On-site PPA vs Off-site PPA

| Aspect | On-site PPA | Off-site PPA |

|---|---|---|

| Location of assets | On company premises | Remote site (solar, wind, etc.) |

| Available volume | Limited by site space | Can use large-scale external assets |

| Contract counterparty | Generator | Generator (and often a retail supplier) |

| Wheeling charges | Not required | Required |

| Imbalance exposure | Limited | Exists |

| Impact of relocation/closure | High impact | Lower impact |

3. Physical PPA vs Virtual PPA

Off-site PPAs can be categorized into two main types depending on how electricity is handled.

Comparison: Physical vs Virtual Off-site PPA

| Item | Physical Off-site PPA | Virtual Off-site PPA |

|---|---|---|

| Treatment of electricity | Physically delivered via the grid | Sold on the market; price difference settled |

| Environmental value | Transferred with electricity | Transferred separately |

| Wheeling charges | Required | Not required |

| Simultaneous balancing | Required | Not required |

| Typical use | Common structure in Japan | Widespread overseas; possible in Japan |

In simple terms:

- Physical PPA: You buy the actual electricity

- Virtual PPA: You buy price stability + environmental value while power is sold on the market

4. Cost Structure of Off-site PPAs

The final cost paid by the offtaker consists of three main components:

Three key components

- Generation cost (PPA price)

Includes construction and operation of the renewable asset. - Wheeling charges

Equivalent to a “toll fee” for using the power grid. - Balancing cost (Imbalance)

Costs incurred when actual generation differs from forecast due to weather or variability.

Key point: In Japan, wheeling charges and imbalance costs significantly affect the final price, so a low PPA price does not always mean low procurement cost.

5. Key Risks in Off-site PPAs

The Ministry of the Environment outlines several risks associated with off-site PPAs, including:

Representative risks

- Market price fluctuations

- Weather-driven generation volatility

- Equipment issues or construction delays

- Imbalance (generation vs forecast mismatch)

- Closure or downsizing of the offtaker’s facilities

- Regulatory changes

- Counterparty credit risk

Risk mitigation measures

- Price adjustment clauses

- Use of environmental value for compensation

- Entrusting balancing to a retail electricity provider

- Insurance against under-delivery

- Credit assessment

- Clearly defined termination/change clauses

In short: because the contract is long-term, proper risk controls must be built into the agreement.

6. Implementation Models in Japan

Japan allows two types of off-site PPA arrangements:

● Direct Off-site PPA

- Direct contract between generator and offtaker

- Since 2021, joint associations (kyōdō kumiai) enable contracting without a “closely related entity” requirement

This essentially means the offtaker buys electricity directly from the generator.

● Indirect Off-site PPA (Mainstream in Japan)

- A retail electricity supplier sits between the generator and the offtaker

- Practically implemented via a “three-party master agreement + two-party individual contract”

Because retail suppliers handle balancing and market settlement, this model is currently the most feasible in Japan.

7. Difference from Self-Wheeling (Jiko Takusō)

Self-wheeling is a mechanism for sharing electricity within the same company group or a joint association. It is designed for self-consumption.

Off-site PPAs, meanwhile, are commercial long-term power purchase contracts with an independent generator. Because the purpose and structure differ, they should be clearly distinguished.

Comparison: Self-wheeling vs Off-site PPA

| Aspect | Self-wheeling | Off-site PPA |

|---|---|---|

| Legal position | Internal power sharing within the same group or association | Long-term commercial PPA between generator and offtaker |

| Parties involved | Same corporate group or joint association | Generator and offtaker (often + retail supplier) |

| Purpose | Self-consumption | Renewable procurement + environmental value |

| Environmental value | Varies by scheme | Transferred with electricity |

| Cost structure | Mainly wheeling charges | PPA price + wheeling charges + imbalance |

8. DeepWind Insights

1) A low PPA price does not guarantee low procurement cost

Because wheeling charges and imbalance costs can be large, the PPA price alone can be misleading.

2) Indirect PPAs are likely to remain the mainstream model in Japan

Given the role of retail suppliers in balancing and settlement, three-party structures are the most practical.

3) FIP-based renewable projects will likely become more common PPA partners

Because FIP and PPAs are compatible, many new renewable assets will rely on this combination.

4) Self-wheeling and PPAs serve different purposes

Even though the legal framework is becoming more flexible, companies needing reliable environmental value transfer should consider PPAs.

Conclusion

Off-site Corporate PPAs allow companies to procure renewable electricity and environmental value at long-term stable prices. In Japan, Physical PPAs with retail suppliers are the predominant model. Because the total cost includes not only the PPA price but also wheeling charges and imbalance costs, companies must evaluate the full cost structure rather than focusing solely on the contract price.

Understanding the differences between self-wheeling and PPAs is essential to selecting the most appropriate renewable procurement strategy. By considering risks, pricing dynamics, and contract structures, companies can effectively incorporate off-site PPAs into their decarbonization plans.

If you want to know comprehensivIe overview of PPAs and Corporate PPAs, including basic concepts, contract schemes, institutional frameworks in Japan, recent case studies, and key challenges and prospects for the future, check out this article.

👉 What Is a Corporate PPA? Japan Market Guide with Price, Structure & Case Studies

Reference

This article is based on the following official document:

Ministry of the Environment, “Off-site Corporate PPA” (Revised March 2022)

📘 DeepWind Premium Report

Japan’s offshore wind is no longer constrained by ambition — but by viability.

A decision-oriented report synthesizing commercial viability, cost/revenue misalignment, supply-chain constraints, and Round 4 implications.

- Commercial viability (CAPEX/OPEX vs revenue)

- Supply-chain & execution constraints

- Round 4 / re-auction implications