As corporate decarbonisation accelerates, RE100 is gaining global prominence as a benchmark framework for renewable electricity procurement. In Japan, participation has expanded from manufacturing to retail and IT, and there is growing practical interest in topics such as procurement methods, eligibility rules, additionality, and how to use PPAs effectively.

This article provides a comprehensive overview of RE100 — from the basic concept and membership criteria to the status of Japanese companies, procurement strategies for achieving 100% renewable electricity, the latest trends, and the relationship with offshore wind.

If you want to learn more about PPAs and the increasingly popular corporate PPAs, check out this article.

👉 What Is a Corporate PPA? Japan Market Guide with Price, Structure & Case Studies

1. What Is RE100? – A Global Initiative Targeting 100% Renewable Electricity

RE100 (Renewable Energy 100%) is a global initiative in which companies commit to sourcing 100% of the electricity they use from renewable energy. It is jointly run by The Climate Group and CDP, and includes major global companies such as Google and Apple.

RE100’s Objectives

- Expansion of renewable energy markets

- Corporate decarbonisation

- Improved ESG evaluations from investors

- Reduced electricity procurement risk (through long-term PPAs)

RE100 is no longer just an environmental “label”; it has evolved into a framework for fundamentally reshaping corporate electricity procurement strategies.

Main source for this section

2. RE100 Membership Criteria (Aligned with Technical Criteria / 2025 Reporting Guidance)

Companies participating in RE100 must comply with internationally unified Technical Criteria and the 2025 Reporting Guidance, ensuring the quality and transparency of their renewable electricity procurement.

Updates during 2024–2025 have become particularly stringent, shifting expectations from a focus on “quantity” toward a much stronger emphasis on the “quality” of renewable electricity procurement.

2-1. Technical Criteria 2024–2025: Key Points

Under RE100’s Technical Criteria, companies are required to manage “what kind of power they procure, and by what method” in a detailed and traceable way. The following five elements are especially important.

① Stricter rules on the generation year (“freshness”) of certificates

Older certificates no longer count, and it has become mandatory to clearly disclose the generation year of the electricity behind the certificates. Companies are also required to provide tracking IDs, significantly improving transparency around certificate use.

② Strengthened focus on additionality

Procurement from new renewable assets is now valued much more highly, increasing the importance of PPAs and onsite generation. In contrast, strategies that rely primarily on bulk purchase of certificates to “hit the target” are evaluated less favourably.

③ Clarification of eligible procurement methods

RE100 recognises several procurement methods, but they are not evaluated equally. Key options include:

- Offsite PPAs (long-term contracts)

- Onsite generation (self-consumption)

- Green electricity tariffs

- Tracked non-fossil certificates (including J-Credits and others)

④ Market boundary and regional matching

The principle that certificates can only be used within the same electricity market in which they were issued has been clarified.

For example: certificates generated outside the EU cannot be used to claim renewable consumption within the EU.

⑤ Laying the groundwork for 24/7 CFE (time-matched procurement)

While not yet mandatory, 24/7 Carbon-Free Energy (CFE) is referenced as a recommended direction, and an increasing number of companies are being asked to provide time-based data on their electricity use and procurement.

2-2. Key Points of the 2025 RE100 Reporting Guidance (June 2025 Update)

The 2025 Reporting Guidance significantly expands the information that companies must disclose. As a result, both the quality and transparency of renewable electricity procurement are now evaluated more strictly than ever.

① Expanded mandatory items in annual reporting

Companies must report, on an annual basis:

- Total annual electricity consumption

- Renewable electricity volumes by procurement method (PPA / onsite / certificates)

- Generation year of the certificates used

- Market / country of certificate issuance

- COD (commercial operation date) of PPA-linked assets

- Explanations of additionality (contribution to new capacity)

② Enhanced transparency for certificate use

Older certificates are no longer counted toward RE100 progress, and disclosure of tracking IDs is required. We have entered an era where “non-additional” procurement is no longer highly valued.

③ Stricter treatment of Scope 2 (market-based)

Consistency with CDP and the GHG Protocol has become essential. For Japanese companies in particular, this means they must handle Scope 2 accounting more carefully when using non-fossil certificates.

④ Standardised calculation of achievement rates

Achievement rates are now standardised based on eligible renewable electricity alone, and it is explicitly stated that different procurement methods carry different weights in evaluation (with PPAs generally receiving the strongest recognition).

⑤ Encouragement of external verification

For large corporates, third-party verification is effectively becoming a requirement. Systems to ensure that data accuracy and transparency are externally verified are increasingly expected.

Main sources for this section

2-3. Practical Implications in 2025 (DeepWind’s View)

The 2025 updates to the Technical Criteria and Reporting Guidance are creating clear changes in how companies procure renewable electricity in practice.

First, certificate-heavy decarbonisation models are reaching their limits.

Because older certificates are no longer counted and low-additionality procurement is less highly valued, companies that have relied heavily on certificates are being forced to revisit their strategies. Going forward, the centre of gravity will inevitably shift toward PPAs.

At the same time, the importance of PPAs is higher than ever.

PPAs are recognised as a procurement method that delivers both:

- High additionality (supporting new renewable capacity), and

- Long-term cost stability.

As a result, PPAs are rapidly gaining prominence as a key instrument that benefits both sustainability and financial strategy. From an ESG and disclosure perspective, “how much of your procurement is via PPA?” is becoming directly tied to corporate value.

Another important change is the rising cost of data management.

Companies must now manage much more detailed information, including generation year, market/region of origin, COD of assets, and tracking IDs. This places a heavier data-integration burden on companies with many sites and business units.

In response to this complexity, stronger governance over electricity procurement has become essential. Procurement, sustainability, finance, and top management need to coordinate across organisational boundaries and treat renewable electricity procurement as a core business decision, rather than a purely environmental initiative.

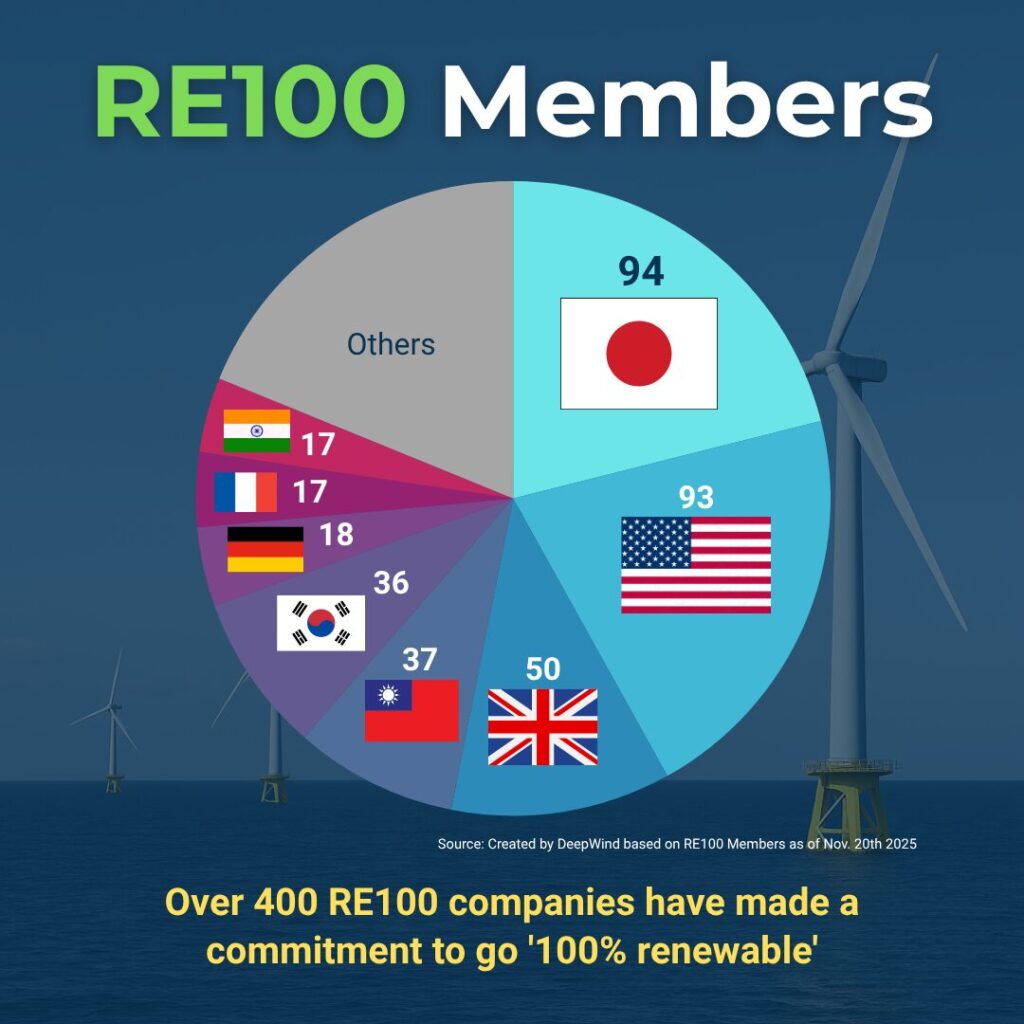

3. RE100 Participation by Japanese Companies (2025 Edition)

Participation by Japanese companies in RE100 has grown sharply in recent years, and RE100 is increasingly becoming a core element of corporate competitiveness in the context of decarbonisation.

The Japanese market has several distinctive features:

- A non-fossil certificate market that has developed rapidly

- Offsite PPAs have expanded quickly since around 2022

- GX (Green Transformation) policies and the FIP scheme are encouraging new wind and solar development

These factors are gradually making it easier for companies to procure renewable electricity. At the same time, global customers — especially in Europe and North America — are increasing pressure for supply-chain decarbonisation, which is further driving Japanese companies to join RE100.

By sector:

- Manufacturing is advancing additionality-focused strategies built around PPAs.

- Retail companies tend to combine green tariffs with onsite solar.

- Real estate players are beginning to roll out building-level RE100 responses (so-called “RE100 buildings”).

RE100 Member Companies in Japan – 94 Companies as of 20 November 2025

Below is an embedded table of Japanese RE100 companies (94 in total), including joining year, target year, and sector classification.

Major Japanese RE100 companies include:

Asics / Daiichi Sankyo / Eisai / HOYA / Ono Pharmaceutical / Otsuka Holdings / Shimadzu / Nissin Foods Holdings / Ajinomoto Group / Asahi Group Holdings / Kirin Holdings / Meiji Holdings / Sapporo Holdings / Sumitomo Forestry Group / Watami / Daibiru / Daito Trust Construction / Daiwa House Group / Envipro Holdings / Hazama Ando / Hulic / Ichigo / INFRONEER Holdings / Kumagai Gumi / Mitsubishi Estate / Mitsui Fudosan / Mori Building / Nishimatsu Construction / Nomura Real Estate Holdings / Prime Life Technologies / Sekisui Chemical Group / Sekisui House / Toda Corporation / Tokyo Tatemono / Tokyu Construction / AESC / Advantest / Alps Alpine / AMADA / Casio / Citizen Watch / Diamond Electric Holdings / DMG Mori / Fujifilm Holdings / Fujikura / Hamamatsu Photonics / KOKUSAI ELECTRIC / Konica Minolta / Murata Manufacturing / NGK Insulators / Nikon / Nitto Denko / Noritz / Okamura / Panasonic Holdings / Ricoh / ROHM / Seiko Epson / Sharp / Sony Group / Sumitomo Rubber Industries / TDK / TOTO / Unicharm / Asahi Kasei Homes / Kao / LIXIL / AEON / ASKUL / J. Front Retailing / Marui Group / Rakuten / Seven & i Holdings / Shiseido / Takashimaya / Tokyu / Fujitsu / Asset Management One / BIPROGY Group / Coop Sapporo / Dai-ichi Life Insurance / dentsu / Fuyo General Lease / Japan Real Estate Investment Corporation / Johnan Shinkin Bank / KDDI / LY Corporation / NEC / Nippon Life / Nomura Research Institute / SECOM / SoftBank / T&D Insurance Group / Tokyu Land Corporation

4. Renewable Electricity Procurement Strategies for Achieving RE100

Broadly speaking, there are four main procurement options for achieving RE100 targets.

First, onsite PPA (self-consumption model) can be introduced with little or no upfront CAPEX, and offers high additionality. It is particularly effective for large consumption sites such as factories and logistics centres.

Second, offsite PPAs are generally regarded as the most highly valued procurement method. Thanks to long-term fixed prices, they provide cost stability, secure additionality, and work well with large-scale assets. As a result, they are increasingly positioned as the core of corporate renewable electricity strategies, and their contribution to ESG performance is highly visible.

Non-fossil certificates (including tracked NFCs and J-Credits) are a Japan-specific option that remains useful due to low implementation hurdles. However, their additionality is limited, and from 2025 onward, tighter constraints on generation year and regional matching mean they are more suited as a supplementary tool rather than the main pillar.

Green electricity tariffs from utilities are the easiest option to adopt, but from 2025 onward it has become critical to understand what kind of certificates are behind the tariff. Transparency of the underlying attributes is now an important evaluation point.

A practically optimal portfolio for many companies might be something like:

“Use offsite PPAs as the core, complement with onsite generation and certificates, and cover the remaining residual load with green tariffs.”

5. Offshore Wind × RE100 – A “Structurally Inevitable” Combination for Japan

Japan faces a structural shortage of renewable supply. Existing solar, biomass, and onshore wind alone are not sufficient to cover the electricity volumes required by large corporates participating in RE100. In this context, offshore wind is emerging as the most important supply source.

Offshore wind can provide large-scale and relatively stable output, is typically developed as new capacity (high additionality), and is highly compatible with long-term PPAs of around 20 years. With LCOE on a downward trend and limited land availability for onshore projects, the combination of RE100 × PPAs × offshore wind is set to become a central pillar of Japanese corporate decarbonisation strategies.

6. Latest RE100 Trends (2024–2025)

With the recent updates to the Technical Criteria and Reporting Guidance, RE100 is clearly shifting toward a “quality over quantity” procurement model. The new framework places much greater emphasis on:

- Newness of generation assets

- Transparency of tracking

- Generation year

- Regional market consistency

In parallel, the shift away from certificate-heavy models is advancing. Constraints on generation year and additionality evaluations are pushing companies to adopt PPA-centred strategies as a practical necessity.

At the same time, the 24/7 CFE model promoted by companies like Google and Microsoft is gaining traction, and RE100 is gradually moving in a similar direction by recommending time-matched procurement. In Japan, discussions around time-matching of renewable supply and demand are likely to intensify in the coming years.

Taken together, these requirements strongly favour offshore wind as a power source that can satisfy multiple criteria: new capacity, large scale, long-term supply, and high additionality.

Conclusion – Japan’s RE100 Is Entering the “PPA × Offshore Wind” Era

Through the 2024–2025 updates, RE100 has evolved into a more substantive model for renewable electricity procurement. The era of certificate-heavy approaches is coming to an end, and companies are being pushed toward PPA-centred strategies in which newness, additionality, and transparency are all critical.

Within this transition, offshore wind is set to become a core power source underpinning Japanese corporate decarbonisation.

DeepWind will continue to track cost models, PPA markets, and offshore wind project developments, and provide insights that support corporate decarbonisation strategies in Japan.

If you want to know comprehensivIe overview of PPAs and Corporate PPAs, including basic concepts, contract schemes, institutional frameworks in Japan, recent case studies, and key challenges and prospects for the future, check out this article.

👉 What Is a Corporate PPA? Japan Market Guide with Price, Structure & Case Studies

📘 DeepWind Premium Report

Japan’s offshore wind is no longer constrained by ambition — but by viability.

A decision-oriented report synthesizing commercial viability, cost/revenue misalignment, supply-chain constraints, and Round 4 implications.

- Commercial viability (CAPEX/OPEX vs revenue)

- Supply-chain & execution constraints

- Round 4 / re-auction implications